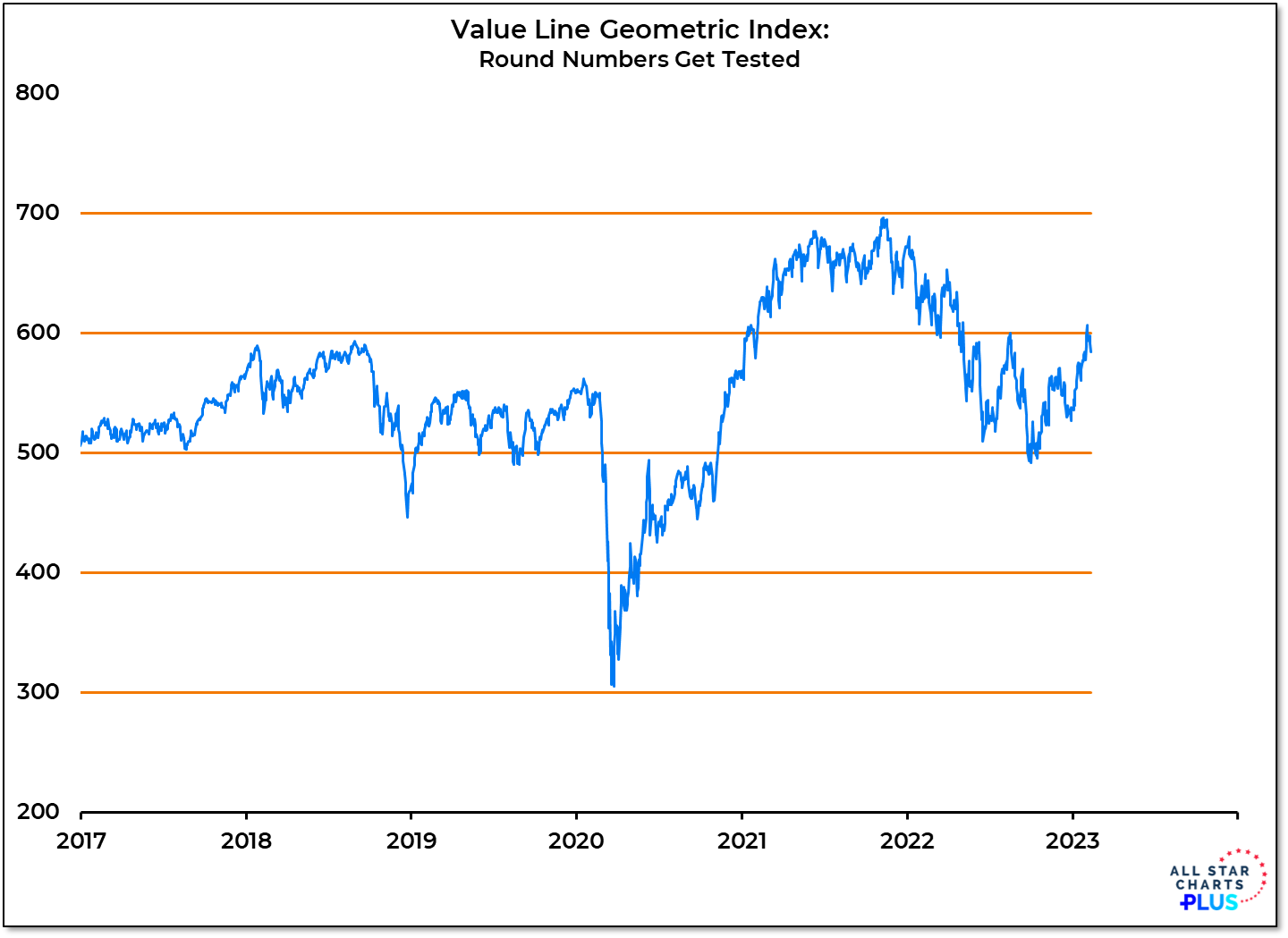

The Value Line Geometric Index peeked above its August high but it continues to struggle with sustaining strength. We don’t have evidence at this point of that being a meaningful peak but for now this proxy for the performance of the median US stock is trodding across well-traveled ground.

More Context: The Value Line Geometric index has a penchant for living between round numbers. In the years prior to COVID, it moved up from 500 to 600 and back down to 500. During 2020, it dropped to 300 before recovering and settling in beneath 500. A break above that level led to a quick test of 600, Further strength carried it to 700 in late 2021. It paused at 600 before spending most of last year moving back and forth between 500 and 600. After a strong start to the year for stocks, some near-term consolidation (especially in the US) would not be surprising. If recent patterns hold, that could mean the Value Line Geometric Index moving back toward 500. If that scenario is going to play out, we are likely to see more broad market weakness than is currently being observed. Right now we are in the midst of the longest stretch of more stocks making new highs than new lows (28 days and counting) since July 2021.

In our Market Notes, we look across time frames at evidence that the rally off of the Q4 lows may be due for pause and what that means for asset allocation decisions going forward.