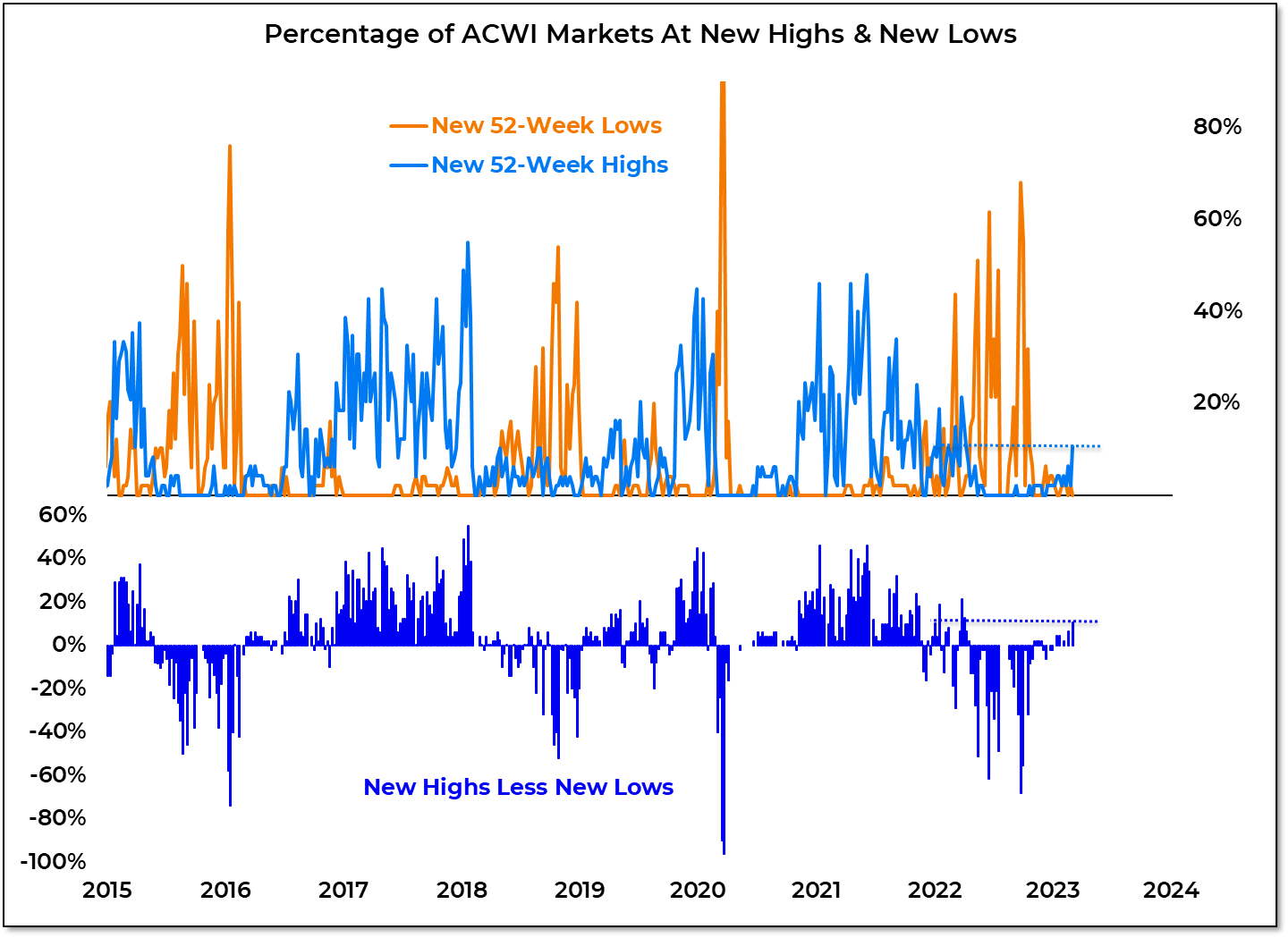

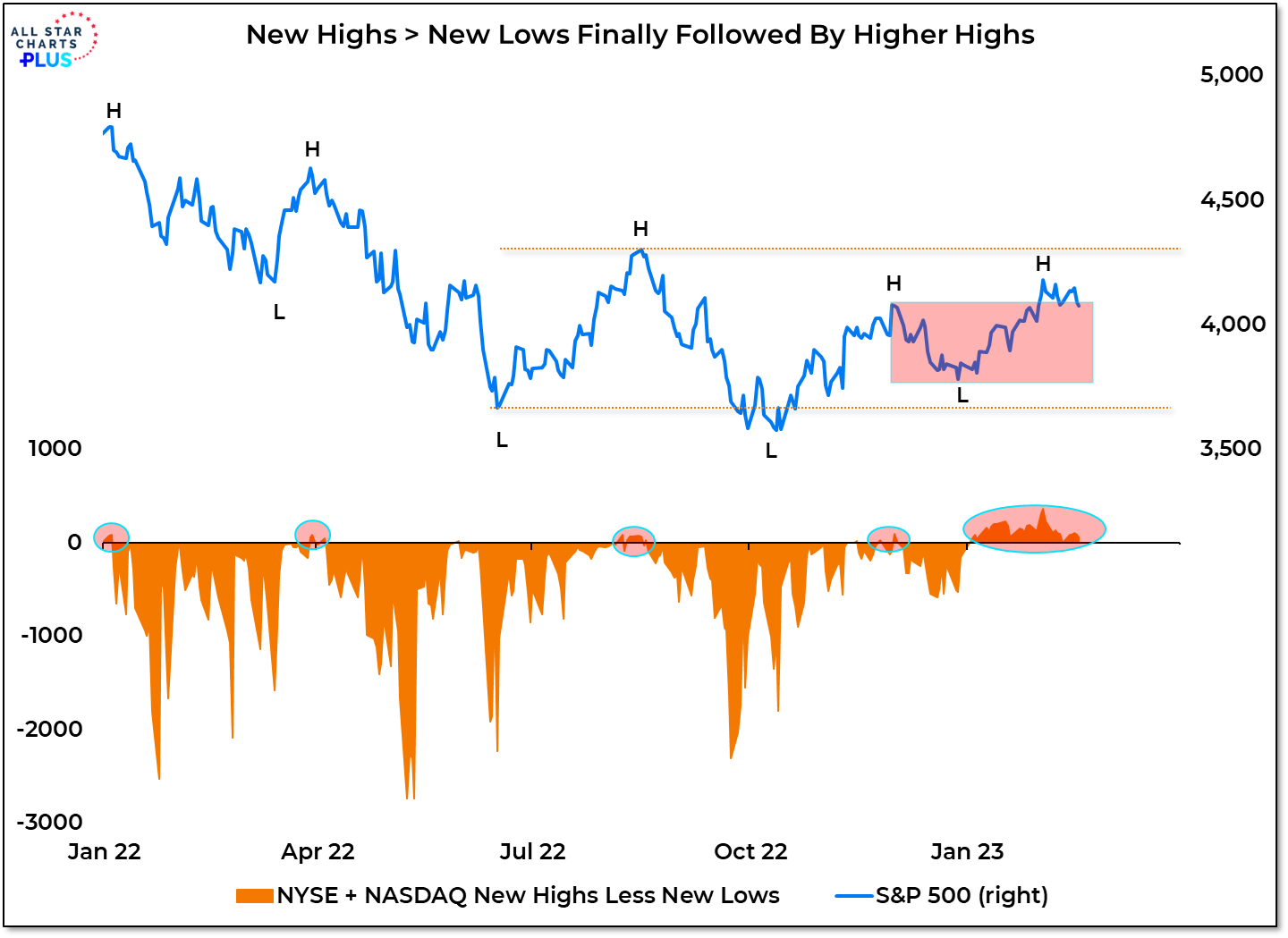

Even with the impressive bounce heading into the weekend, the S&P 500 last week didn’t even get back up to its December high. Meanwhile nearly 10% of the industry groups in the S&P 1500 and more than 10% of global markets closed at new 52-week highs. That’s the longest new high list by the rest of the world in nearly a year.

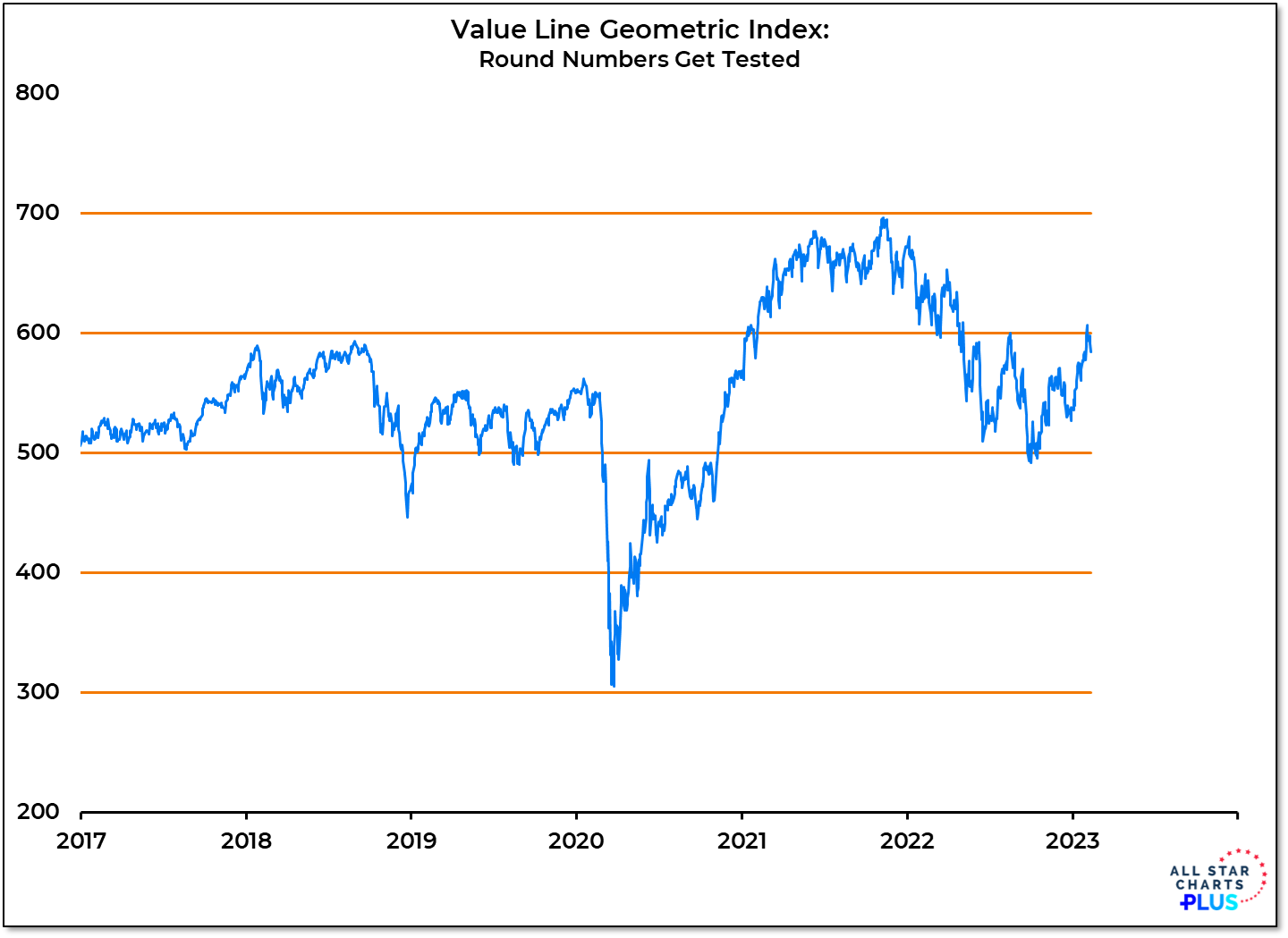

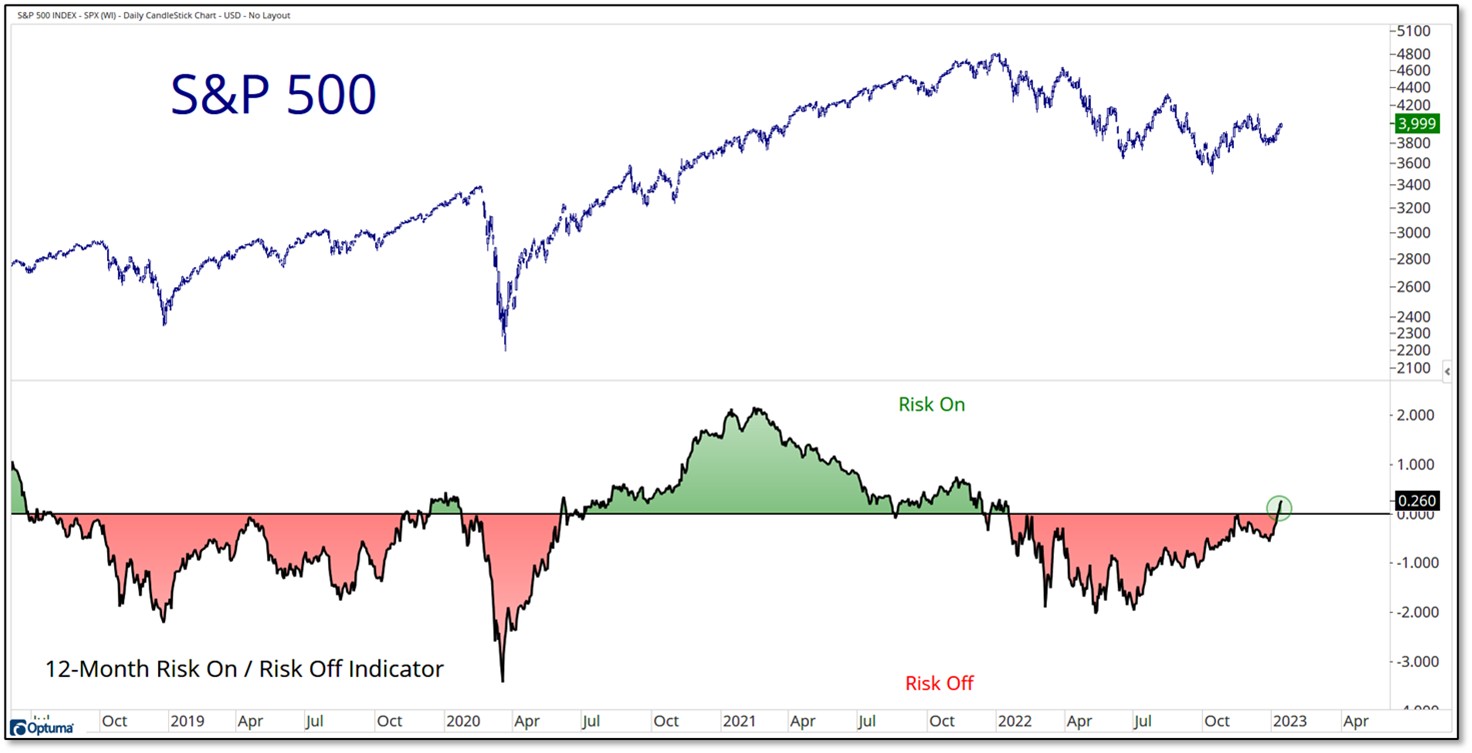

More Context: The last decade has conditioned investors to look to the S&P 500 for leadership. Many have concluded that if US large-cap stocks are not showing strength there isn’t much opportunity in equities. That is becoming an expensive assumption. Our global equity work is tilting away from US exposure and within the US, large-cap growth is approaching max underweight. Getting stuck in the last decade’s paradigm means not seeing the strength that is emerging in this new environment. The S&P 500 continues to move sideways between its June low and August high and is contending with a challenging trend backdrop. It’s time to turn the page on that index and embrace new leadership.

In our Market Notes, we take a closer look at the opportunities that can be found when we get beyond our US large-cap growth biases.