This is the video recording of our July 1st Monthly Charts Live Strategy Session

[Premium] Monthly Charts Strategy Session June 2024

by JC

This is the video recording of our June 3rd Monthly Charts Live Strategy Session

Bonds Are Still Crashing

by JC

This historic bond market crash continues.

And to be fair, it might not seem like a “Crash” because bond market volatility is still relatively low.

So it’s just been a slow painful grind lower.

But there’s no evidence that it’s over.

You can see the Japanese Yen continuing lower as well…. [Read more…]

[Premium] Mid-Month Conference Call Video Recording May 2024

by JC

This is the video recording of the May 2024 Mid-month Conference Call.

How Much Longer Can This Last?

by JC

How’s this messy market treating you?

Are you happy the market is a mess? Or do you find it frustrating?

Keep in mind, the S&P500 is still at the same price it was 2 months ago.

Both the Nasdaq100 and Dow Jones Industrial Average are still at the same prices they were back in February.

We’re almost half way through May.

The Technology Index, which is the largest component of the S&P500 (30%) and has the largest weighting in the Nasdaq100 (50%), is still where it was back in January.

Again we’re half way through May!

Meanwhile, don’t forget about the Small-cap Russell2000 that’s hilariously still stuck below where it was way back in December.

The Consumer Discretionary Index and Dow Jones Transportation Average are also down for the year.

That’s the market we’re in.

Some people keep pretending that this year is just like last year.

But I cheated. I actually looked at the data. So I know better. [Read more…]

Final Shakeout before the Ripper?

by JC

What’s on your mind these days?

I’ll tell you what I’m thinking about.

I’m used to a market where stocks struggle when the US Dollar are US rates are rising. And that’s what we’ve seen all year.

And while the data certainly points to a market of stocks that have been grinding mostly sideways over the past few months, stocks haven’t done nearly as bad as you’d think, considering just how strong the Dollar has been and how much rates have risen.

So the question for me is whether these consolidations are going to resolve higher or lower?

And what the implications might be….

A lower resolution here could be a massive tailwind for stocks.

Remember, during Election years, the market tends to bottom in May ahead of a very strong summer, particularly when there is an incumbent candidate.

If these resolutions are, in fact, to the downside, then that’s exactly what I would expect to see happen: [Read more…]

US Interest Rates: New 6-month High

by JC

Imagine being one of these people who are lying to US citizens about falling interest rates?

Or worse, imagine being one of the poor victims who actually believed them?

Ouch.

The people lying to you include journalists across old media, a few economists that are somehow still employed, and even the President of the United States of America.

Or maybe the Biden didn’t actually lie to you. It could have been the intern, who tells him what to say, that is the one behind the false information.

Either way, none of these people are here to help you. They’re only here to help themselves. That’s how this works.

So as investors, it’s important for us to actually look to see what’s happening, instead of blindly trusting some random source, even if that includes the President of the United States, who’s been lying to you about falling interest rates all year.

Is the fact that he is up for reelection later this year further incentivizing these lies?

Probably.

It’s malicious. Criminal even.

And this isn’t a political thing. It has nothing to do with which candidates you like or dislike.

This is a just a making money thing for me.

So if you’re like me and are more interested in reality, instead of the lies they tell you on the cartoon networks, then just take a look for yourself.

Here’s the US 10yr Yield and US 30-year yield closing the week out at the highest levels in 6 months: [Read more…]

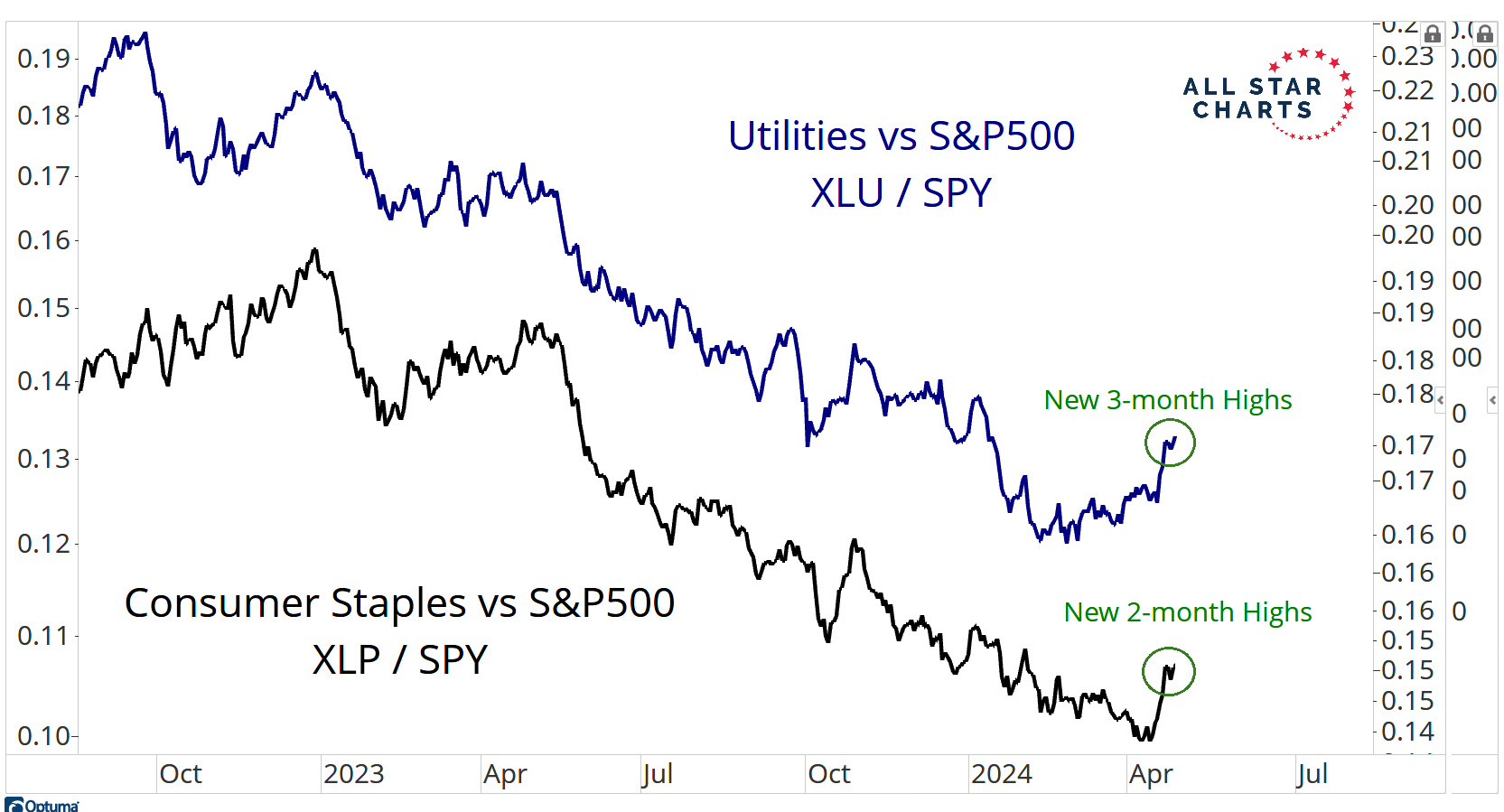

The Defensive Rotation Is Here

by JC

You’re finally seeing some of that defensive rotation with Utilities representing the only sector that is hitting new 6-month highs this week.

Here is a chart of Utilities relative to the S&P500, overlaid with Staples relative to S&Ps as well.

As you can see, both of these lines had been falling since 2022, because it’s been a bull market.

But now that stocks have been correcting this year, you’re seeing that outperformance coming from the most defensive sectors:

- 1

- 2

- 3

- …

- 43

- Next Page »