Nothing goes straight up right? Of course not.

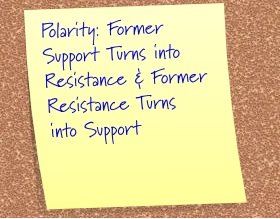

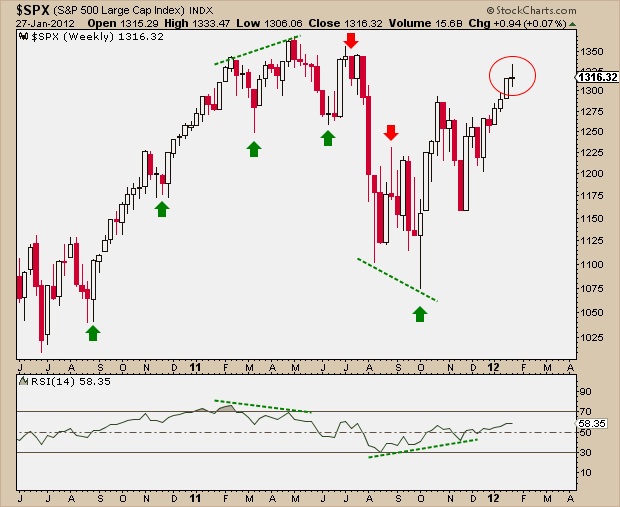

Remember, the Market behaves a lot like us humans. We can’t just sprint and sprint forever. At one point or another we need to stop, chill out a bit, take a nap, and then we can keep going. The market acts the same way. These “chilling out” periods, or corrections, can take place one of two ways: through price or through time.

When uptrends correct through price, you often see a sell-off that can get down to anywhere between 38.2% – 61.8% of the previous up move. Other times, you don’t see a price correction at all. You actually see a pause in trend with some sideways trading action. I typically chalk this up as evidence of a strong trend.

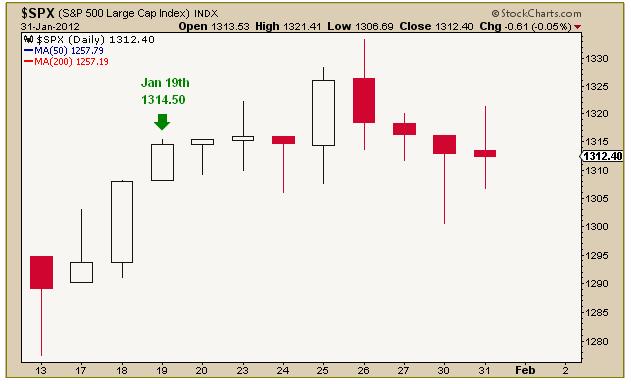

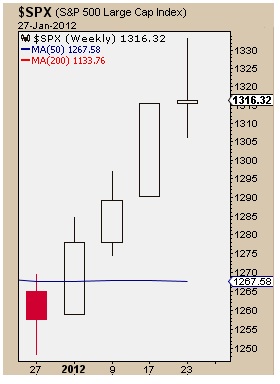

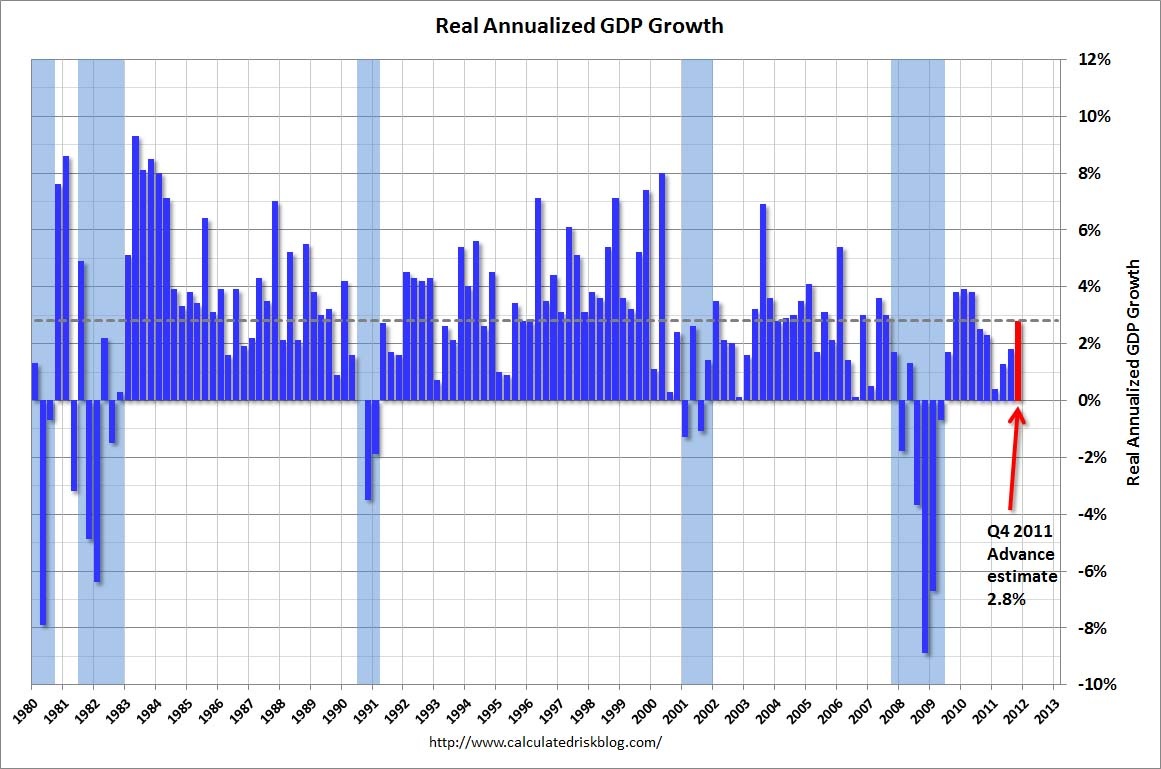

Two Thursdays ago on January 19th, the S&P500 closed at 1,314.50 and the Dow Jones Industrial Average closed at 12,623.98. Today, the S&P closed at 1,312.79 and the Dow finished up at 12,637.83. Both pretty much unchanged after 8 trading days of consolidation. Meanwhile, the Russell2000 ($IWM) is up 1.1% during that time period, the Nasdaq100 ($QQQ) is up 1.1%, Emerging Markets ($EEM) are up 1.7% and Commodities ($DJP) are up 1.7%. That is the sort of relative strength you want to see while the broad markets are busy consolidating.

So yes, the Dow and S&P haven’t been going up. But more importantly, they haven’t been going down. There is an old saying out there that ‘you never want to short a dull market’. And guess what? It doesn’t get more dull that this….

Tags: $SPY $ES_F $SPX $DIA $DJIA