I’m not hearing much about the retailers these days. That should change come earnings season, but by then I hope to be taking profits. RTH is the Retail Holders Exchange Traded Fund. The holdings consist of a bunch of companies that sell stuff to us: Walmart, Home Depot, Best Buy, Walgreen’s, Target, Amazon, etc

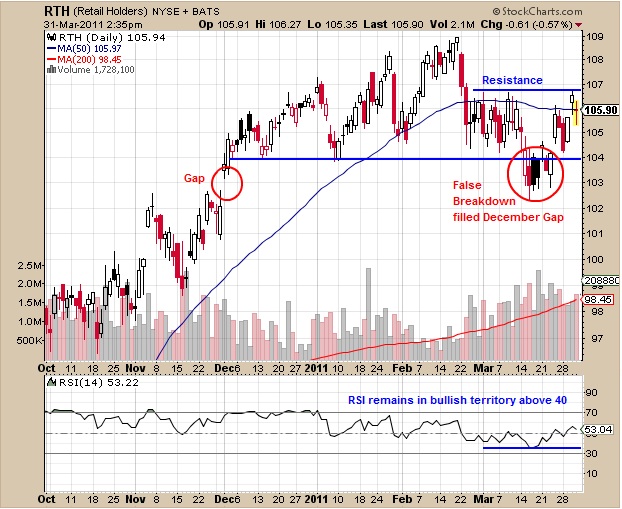

RTH looks interesting here. The false breakdown after the Japan disaster took RTH down under support to fill that Gap from early December. This could cause a nice squeeze that could take RTH to new 52-week highs. After the gap back above that key 104 level last Wednesday RTH has followed through nicely retesting the 106.75 resistance. If we take that out I would be a buyer of retailers. The question becomes: “Which One?”

I like Amazon here, AMZN. Similar price action to the RTH. AMZN is the 3rd largest holding and represents roughly 11.25% of RTH. A breakout above 182 at the same time that RTH takes out it’s resistance should take AMZN to new all-time highs.

Risk Management here is key so we want to make sure that these breakouts hold. If I decide to get involved in this trade I will most likely put in a stop loss below those key support/resistance levels discussed above.