Last week I had the honor of interviewing one of the most legendary Technical Analysts that you’ll ever meet. Ralph Acampora is a pioneer that helped open doors for the next generation of technicians like myself. I’m not really sure where technicians as a group would be today without guys like him. And for that we are grateful.

In this 3-part series, Ralph shares stories about how he came up in the business, what it was like to chart before computers, how he’s feeling about today’s markets, and what’s up next.

I hope you guys enjoy this as much as I did:

***

Part 1

JC – Before we start digging into the current market environment, why don’t you tell us a little bit about how you got interested in technical analysis in the first place?

Ralph – Well I graduated college as a history major. I spent a couple of years at a Catholic seminary. I came very close to getting a masters in theology. So you can see I have a lot of background in finance (laughs). And then, long story short, I had a very serious automobile accident that changed my whole life around. After I left the hospital, everyone said “what are you going to do with your life?”. I said, “I don’t know I’d like to get into finance”. I was lucky enough to get a job as a junior fundamental analyst but was also spending half my day plotting charts. And then they sent me to school at the New York Institute of Finance where I’ve been teaching at now for 42 years. I love doing that and it’s where I met the great Alan Shaw, who is my mentor and a wonderful friend. So that’s how it started, I was lucky enough to stumble into it. Now it’s my goal in life to get more and more college professors to teach the subject on campus.

JC – That’s a great story Ralph. Now, in my experience I’ve seen a lot of people dismiss technical analysis. And in most of these cases, the poor souls don’t even know what it is. So how would you explain technical analysis to a client or to journalists or individuals who aren’t familiar with it?

Ralph – Well when I first came into the business with Alan Shaw, his mentor was Ralph Rotnem. No one knows the name but you know his stuff. Mr. Rotnem was the original statistician for many many years on Wall Street. The headline indicator, you heard of that right?

JC – Sure

Ralph – That’s Mr. Rotnem. The year end rally, summer rally, presidential cycle, that was him. The guy was phenomenal.

JC – Wow

Ralph – The first day on the job he grabbed me and takes me into the conference room and draws a big circle on the board. He says, “You want to explain the need for technical analysis along with fundamental analysis?” In the middle of the circle he writes out the letters GM, General Motors, and split the circle in half. On the top part of the circle he said, “General Motors is a company”, and he starts to write in that part of the circle: the P/E multiple, management, product, competition….”these are all the things that represent General Motors”. He said most people think it’s all they have to know. “But there’s a part two to General Motors”, and in the bottom half of the circle he wrote the word “Stock”. Stock of GM is the price, the volume, psychology, and time. You put them all together and you have fusion analysis. I think that’s the best way to explain it to people. You need both, one is not more important than the other. I tell people that for the P/E multiple – half the formula is technical, the P. Price is a fact, earnings are an estimate. You restate the earnings. You never restate a chart.

JC – That’s a great point. So then is this more of an art or a science?

Ralph – I think it’s both. The word science, I looked it up in the dictionary many many years ago. It’s a body of knowledge with its own language and its rules. Guess what? We technicians have our own language and we have our own set of rules. So we are a Science. But the interpretation is where the art form comes in. I look at it as doctors would look at an x-ray. I mean they’re all obviously well educated in their science of medicine, but when it comes to interpreting an x-ray – that’s the art form I think. That’s how I compare us with science.

JC – I think that makes a lot of sense. Now, I’m sure you’ve seen this as well, but throughout my short career it’s been pretty easy to notice the growing number of fundamental analysts out there just throwing a lot of that work out the window and focusing more on price action. Why do you think that is?

Ralph- Yes, Well, here’s where my age comes in and the fact that I’ve met many older technicians over the years. When you have a major crisis in the market like the crash of 1929 and people were scurrying around saying, “Gee whatever we’re using (fundamental analysis) didn’t work so we have to look for something else. Technical analysis became very popular after the crash of 1929. I don’t know if you are aware of that.

JC – I wasn’t around

Ralph – It was people like (Ralph Nelson) Elliott and (John) Magee who started writing the book. Go to the MTA library and you’ll see the original book that Mr. Rotnem gave to me to give to the library. So technical analysis became very popular after the major crisis. It also happened in 1973-74 when we had a major break in the market. Technical analysis became very popular then. People like myself that started the association were able to get more and more people interested. Most recently with the break in ’07, ’08, ’09 in the market, people are scurrying around scratching their heads looking for other things to help them. And I think the advent of the computer, with everyone sitting in front of a screen now, and god bless the machine, it runs the numbers. And what does it give you back? Pictures. So everyone has a chart in front of them. That’s the good news; the bad news is they don’t know what they’re looking at. That’s where the education comes in. I’m teaching a class, for example, in Chicago in November for the school (NYIF) and I’ll eventually do virtual classes because I’ll be able to get to more people that way. And the demand is out there for it.

JC – What did you guys do before computers? I was talking about this the other day with David Keller over at Fidelity. He’s been a technician since 2000 or so, and I’ve been around since last decade as well. Before computers charted, what was it like?

Ralph – When you get a chance go to the MTA office on 61 Broadway.

JC – I’ve been there.

Ralph – Have you been to the conference room?

JC – I have not.

Ralph – Go into the conference room and you will see a wall chart that’s 8ft high and 16ft long. I found it and was part of my wall room library of charts when I was at Kidder Peabody in the 1980s and you will see what was done. You’ll see the Dow averages and the oscillators plotted everyday for a 14 year period and you’ll also see the book, the binder, with all the data we had to use. What I stress to everyone is that years ago we were called chartists and rightly so because, #1 we had to collect the data every day. I found the data in Barron’s, or WSJ, or Forbes Magazine. We had to scurry around for the data, collect the data. #2 we had to calculate the data. #3 we had to plot the data. And #4 we analyzed the data. So the first 3 steps are all done by computers today. The plotting is probably the best part of the task because if you keep plotting charts everyday you get a feel that you don’t get with the computer. Something inside me says the old way is a little bit better.

JC – Do you still plot your own charts?

Ralph – No but I do something akin to that. I created a spread sheet with all my numbers in it, my support my resistance levels for everything. You name it, I most likely have it on my spread sheet which is hooked up to my Thompson Reuters system. So my spreadsheet is updating as we speak. If any of the support or resistance levels are broken, guess what I have to do? I have to go back and look at the chart, I update it. The machine is not telling me what trend it’s in. The machine is not dictating where the support or resistance levels are. All the machine is telling me is that I better look at Walmart – it’s doing something important and I love that. So nothing moves JC, nothing moves without me looking at it. And that’s awesome.

JC – Would you like to share your method with us? Do you have a fixed strategy as to how you view the markets? And has that changed throughout your career?

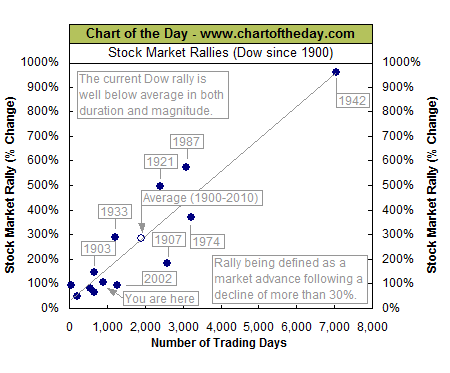

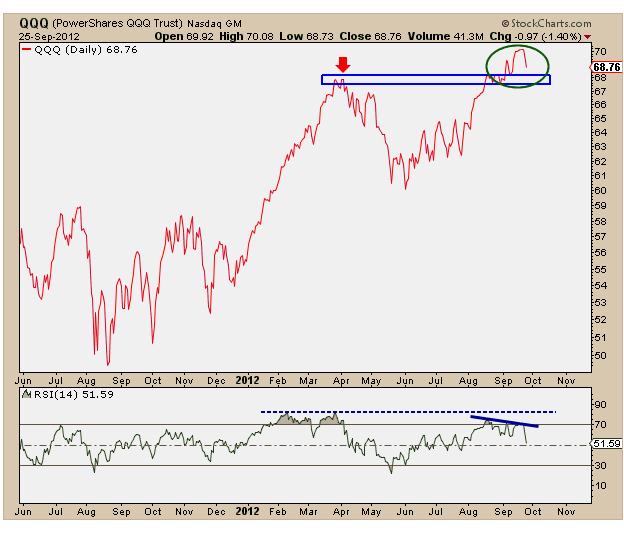

Ralph – First of all, when I look at the markets, all the years that I’ve been in Wall Street I was never a trader so therefore I don’t do the daily stuff that is so prevalent on TV. It’s literally in nanoseconds. To me that’s a lot of noise. I know some people do it and they’re very good at it but that’s not what I do. When I approach the market I approach it from an investor’s long term point of view. I’ve always done that and I continue to do that. Having said that, so what do I do for the long term? I look at Dow Theory. The oldest theory in technical analysis. And not that it dictates what I do, but it gives me a backdrop. “Are we in a rally in a bear market?”, or whatever it says. So I take that, and then as I said to you before, I have my spread sheet, and the old gentleman that I mentioned before Ralph Rotnem, he put his arm around me one day and he said, “Never fight Papa Dow”. So the first things I look at are those 30 Dow stocks. The whole is equal to the sum of the parts. If most of those 30 Dow stocks look good, guess what? I’m pretty optimistic about the market. I look at them on a daily, weekly, and monthly basis so I get a short to medium long-term feel of what they’re doing. So as I do that I start looking at sectors. Of coarse the S&P has 10 sectors and under these sectors they have about 125 or so individual groups that are extremely important. This is all price data that I’m looking at. Then of coarse I’ll bring in the volume statistics and bring in my favorite oscillators. I like RSI and MACD – they work well for me. I look at them again, on a daily, weekly and monthly. That’s the start of what I do.

And then of course with the advent of ETFs, I do an awful lot of work on ETFs because you get a very broad view of what’s going on. I could look at the DAX, for example, because you get to look around the world and get your global, your international. And of course in the words of the famous John Murphy, your “Intermarket analysis”. What a brilliant phrase he came up with in his book talking about the things other than equities that affect stocks, but that you can use the tenets of technical analysis on: commodities charts, currencies, fixed income, etc etc. So I don’t think I do anything super different than most people. I have my own little proprietary way of looking at relative performance, realizing that the most powerful money in the industry, in our business, are the portfolio managers. They’re the ones with the big heavy bats – when they swing at something, they want to not only make money for their clients, they want to outperform. So there’s a combination of price and relative and that combination only comes out to 9 pictures. That’s my whole thing. Those 9 pictures dictate where I’m going to want to be on a price and relative basis.

***

We’ll continue our one-on-one with Ralph Acampora later this week. In the next part of the series, Ralph shares his thoughts on US Equities, Gold, Oil, and the Bond Market. He is teaching a one day Technical Analysis class in New York City on November 14th. To learn more, visit http://www.nyif.com/ralphisback.html.