Ralph Acampora is the inaugural guest on Technical Analysis Radio. The legendary Technician tells us the story of Technical Analysis from the late 1800s, into the 1940 with Edwards & Magee, through his struggles in the 1970s and how we got to where we are today. Then we turn our attention to today’s markets where Ralph shares his thoughts on the current levels of the Dow Jones Industrial Average, why he thinks gold looks attractive and the longer-term direction of interest rates. This is a great kickoff to Technical Analysis Radio in what we hope can be something that adds value to investors all over the world.

The man in his simplicity was a bloody genius

– Ralph Acampora on Charlie Dow

-

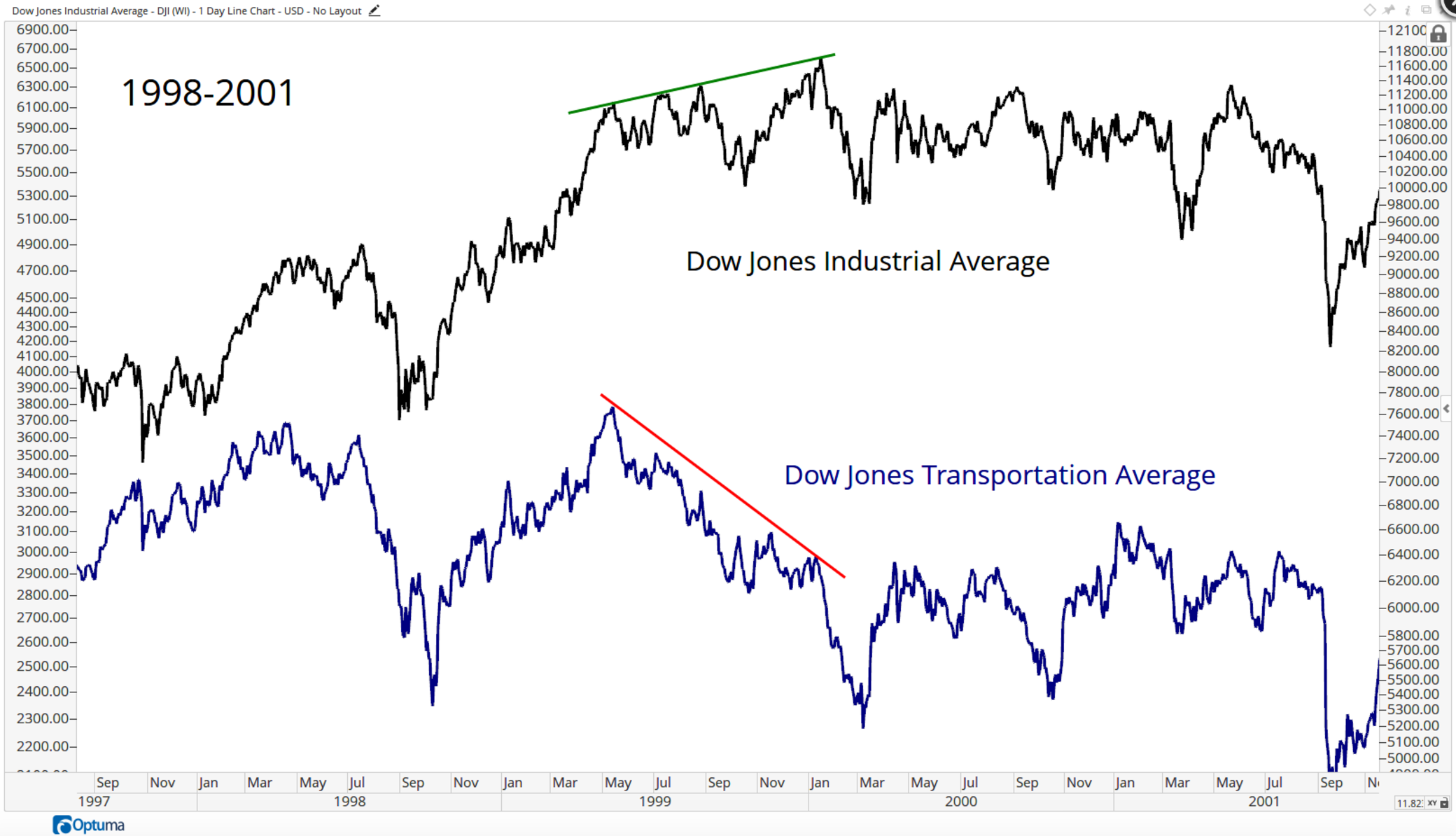

Dow Theory –

-

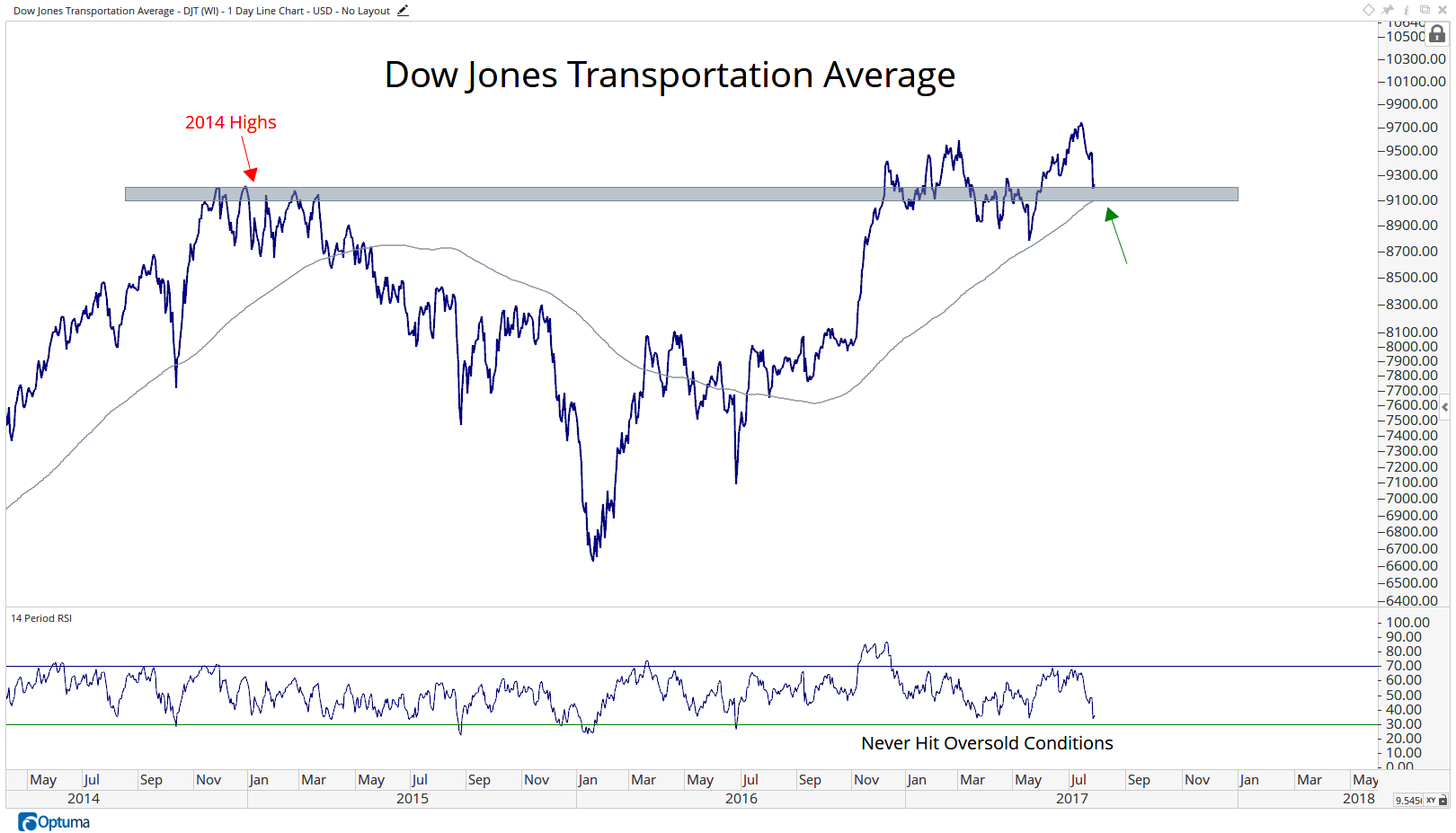

DJ Trans Avg –

-

Energy XLE –

-

Gold –

-

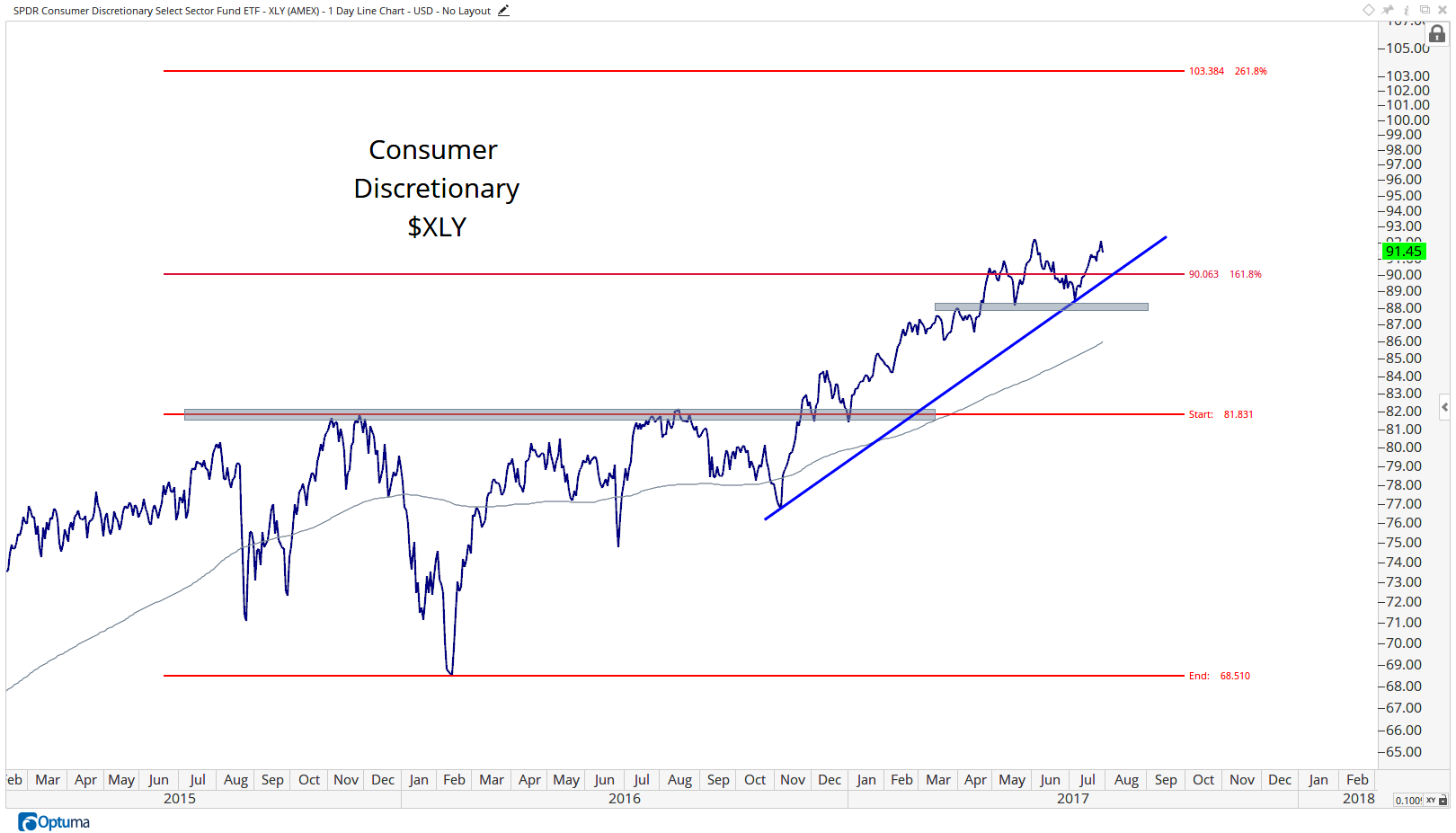

Cons Discretionary XLY –

-

Materials XLB –

-

Copper & EM –

-

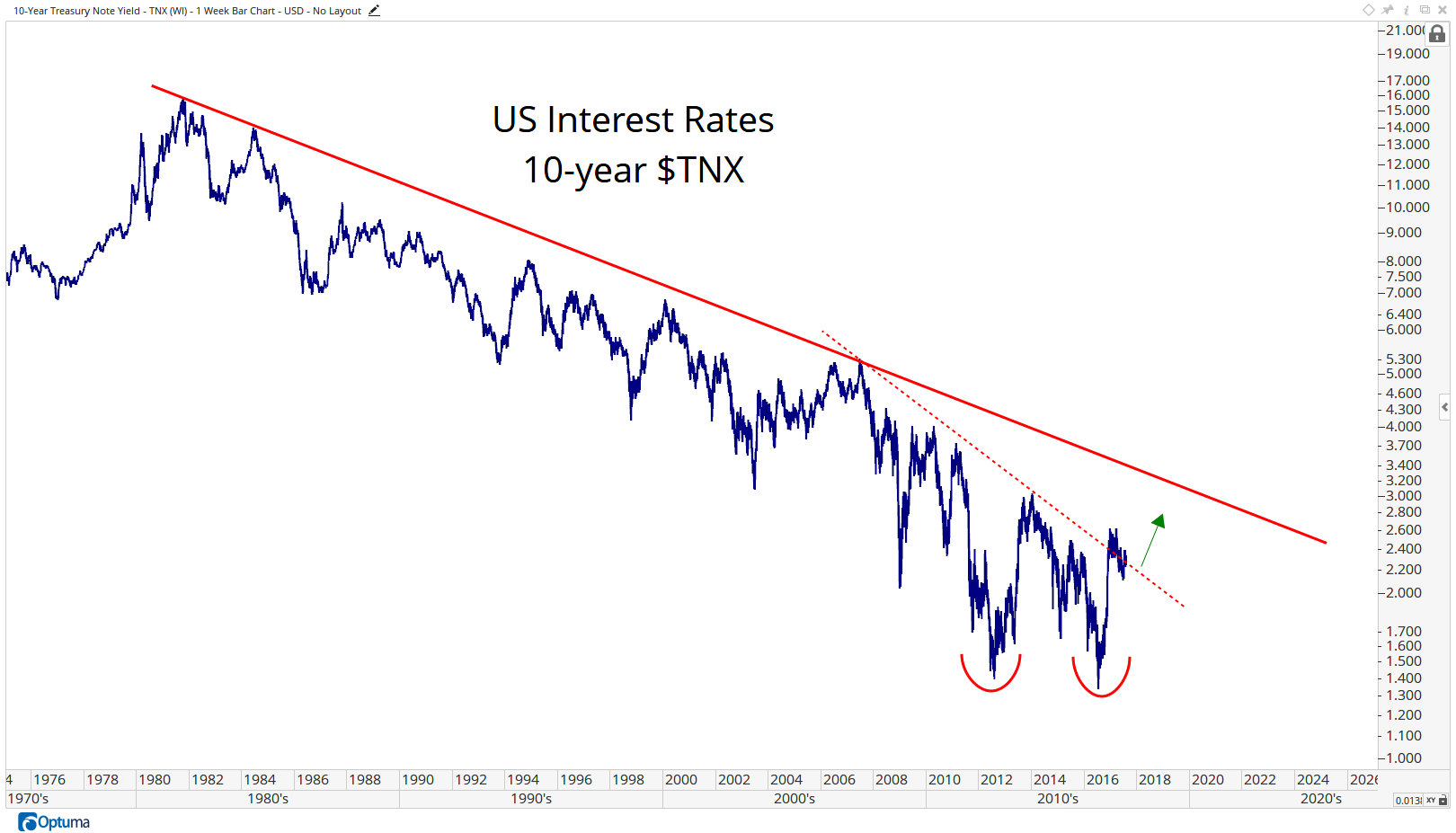

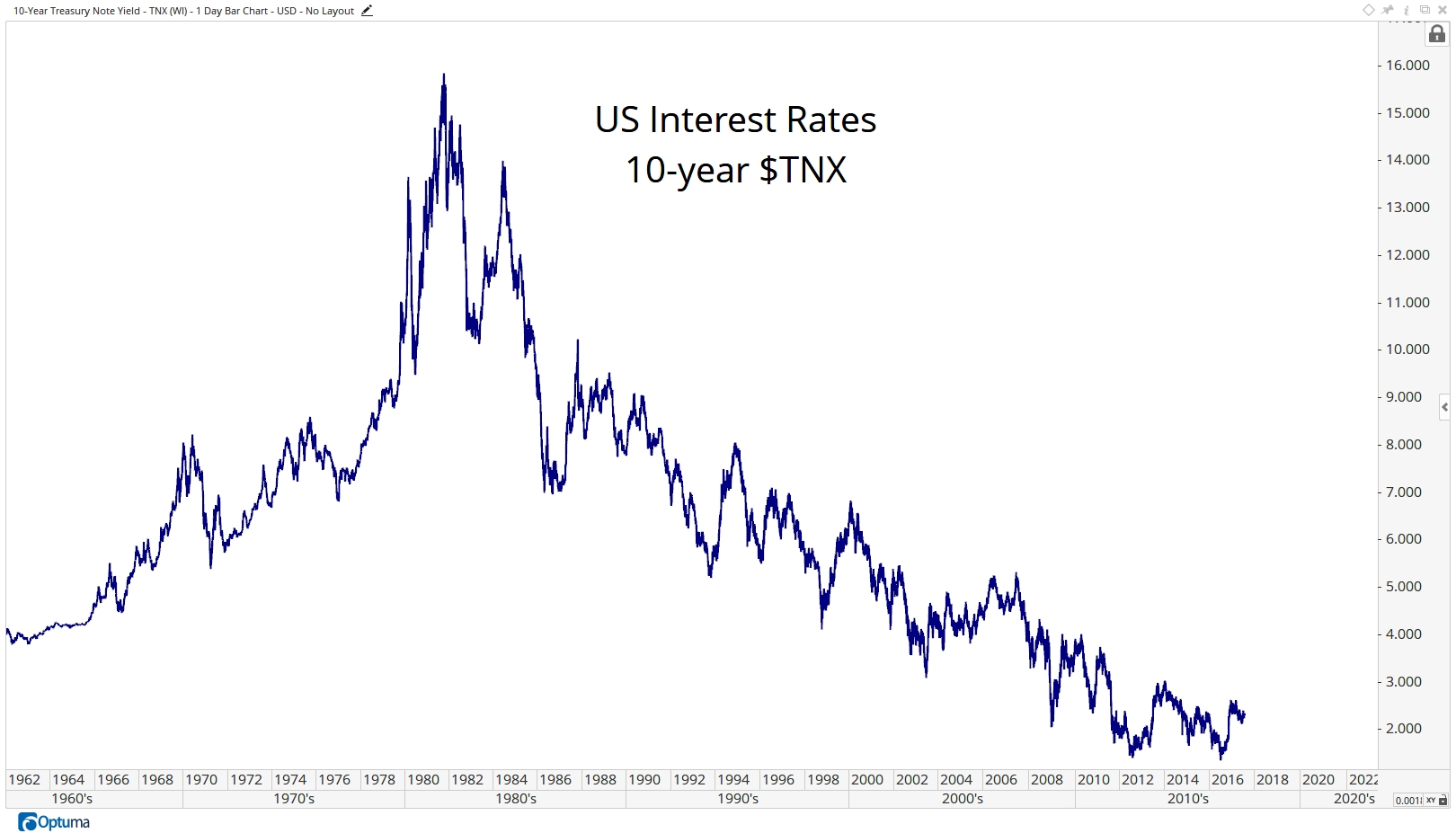

US 10-year Yield –

-

US 10-year Yield –

DJT – Dow Jones Transportation Average

Daily

Last Updated Friday, July 28, 2017

XLE – SPDR Energy Select Sector Fund ETF

Daily

Last Updated Friday, July 28, 2017

XLY – SPDR Consumer Discretionary Select Sector Fund ETF

Daily

Last Updated Friday, July 28, 2017

XLB – SPDR Materials Select Sector Fund ETF

Daily

Last Updated Friday, July 28, 2017

Disclaimer: The information, opinions, and other materials contained in this presentation is the property of All Star Charts, a wholly owned subsidiary of Eagle Bay Capital, LLC, and may not be reproduced in any way, in whole or in part, without express authorization of the copyright holder in writing. The statements and statistics contained herein have been prepared by Eagle Bay Capital, LLC based on information from sources considered to be reliable. We make no representation or warranty, express, or implied, as to its accuracy or completeness. This publication is for the information of investors and business persons and does not constitute an offer to sell or a solicitation to buy securities or subscribe for interest in any investment. This document may include estimates, projections and other “forward-looking” statements, due to numerous factors, actual events may differ substantially from those presented. Opinions and estimates offered herein constitute Eagle Bay Capital, LLC’s judgment and are subject to change without notice, as are statements of financial market trends which are based on current market conditions. An investment in the fund is subject to loss of capital and is only appropriate for persons who can bear that risk and the nature of an investment in the fund. Eagle Bay Capital, LLC is not a registered investment advisor or registered investment company. These materials are not intended to constitute legal, tax, or accounting advice or investment recommendations. Prospective investors should consult their own advisors regarding such matters.