Chris Verrone is a Partner at Strategas Research. Over the years his work has inspired me in several ways and we discuss that in this episode. Chris gives us his take on the US Stock Market, Interest Rates, Gold, Copper and other Base Metals. We talk about the importance of the Industrial Sector as a gauge for the direction of the S&P500. This was a great conversation with a really smart Technician.

-

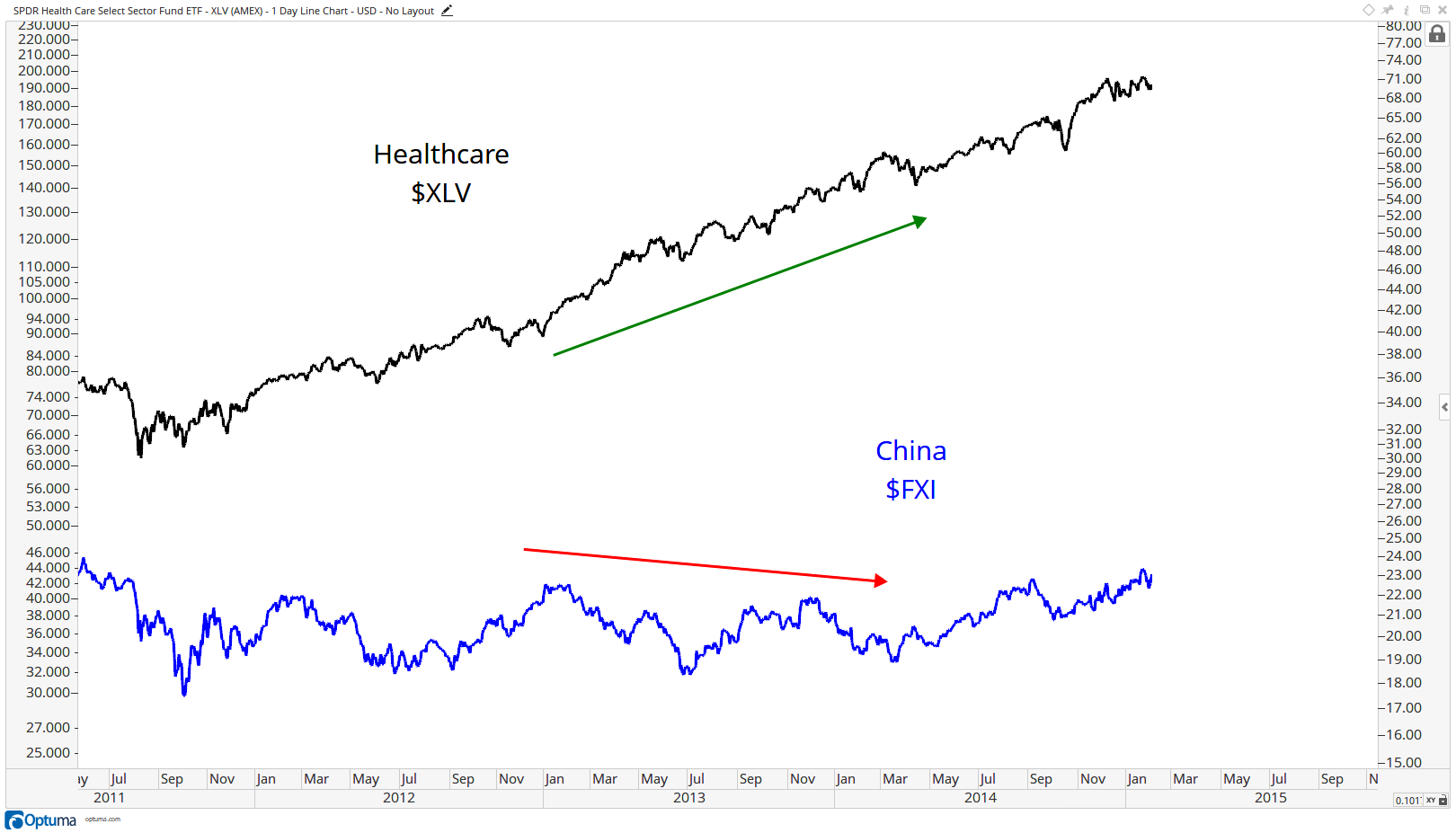

Russia & China Divergence 2013 –

-

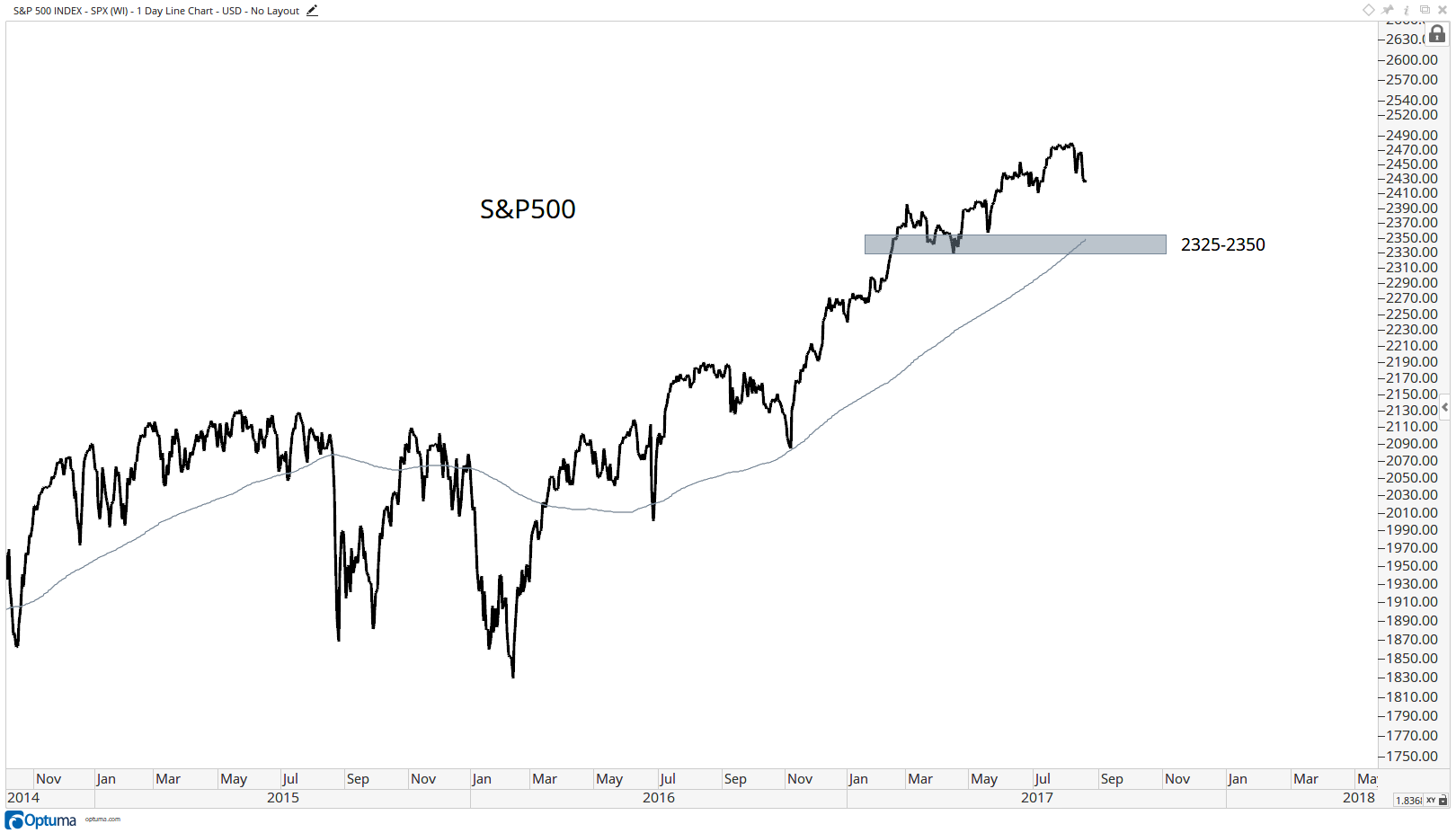

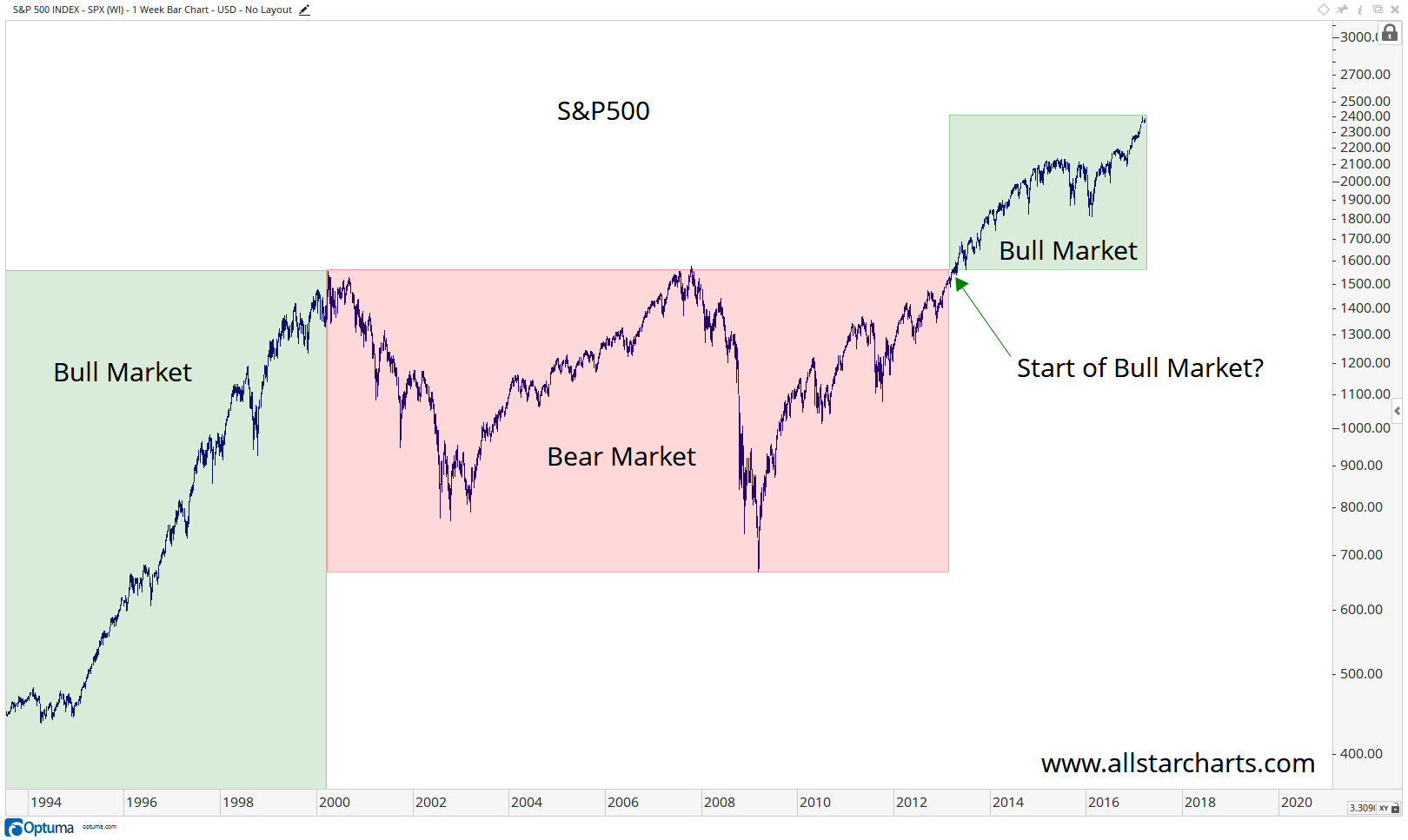

S&P500 –

-

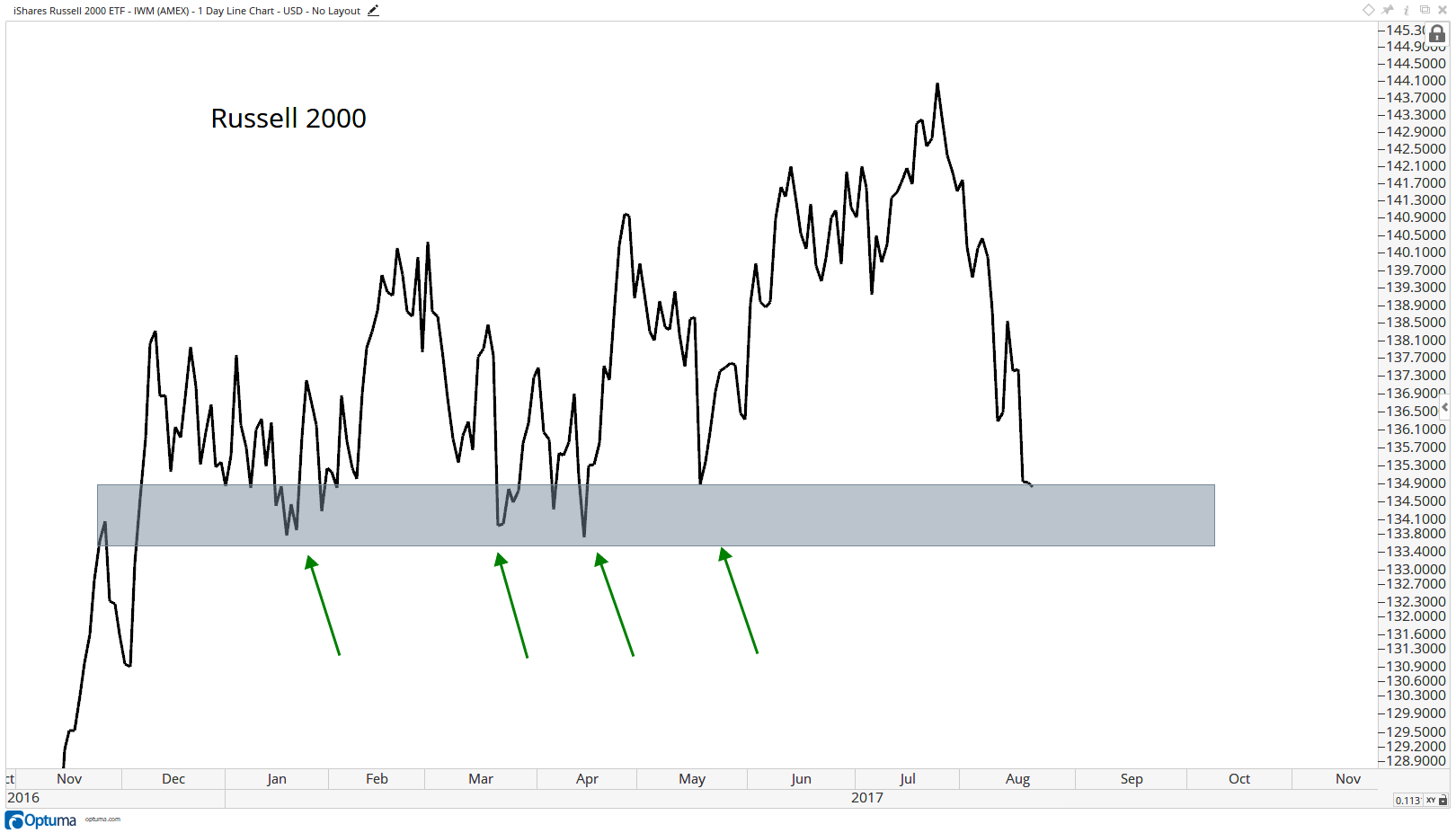

Russell2000 –

-

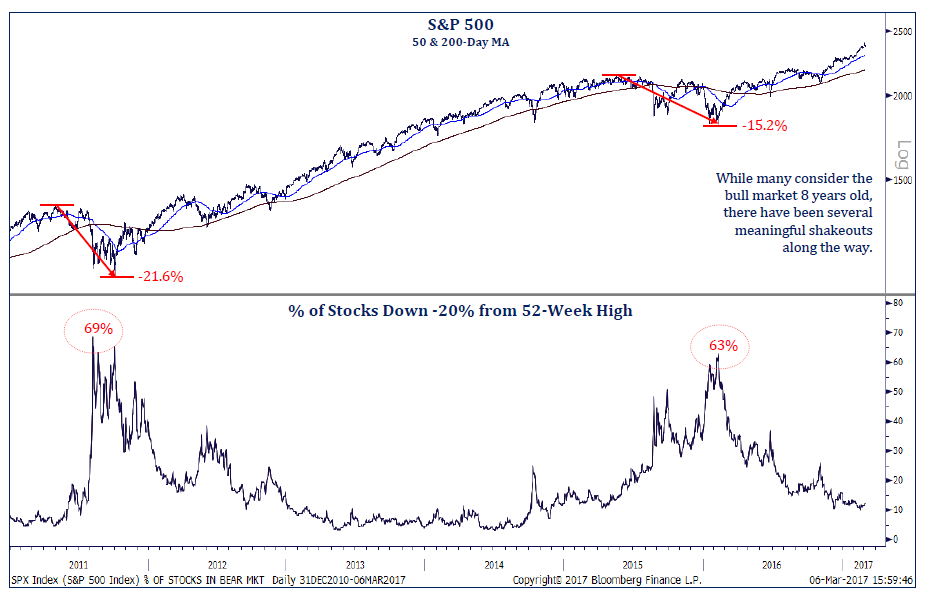

2011 & 2015 Corrections (Internals) –

-

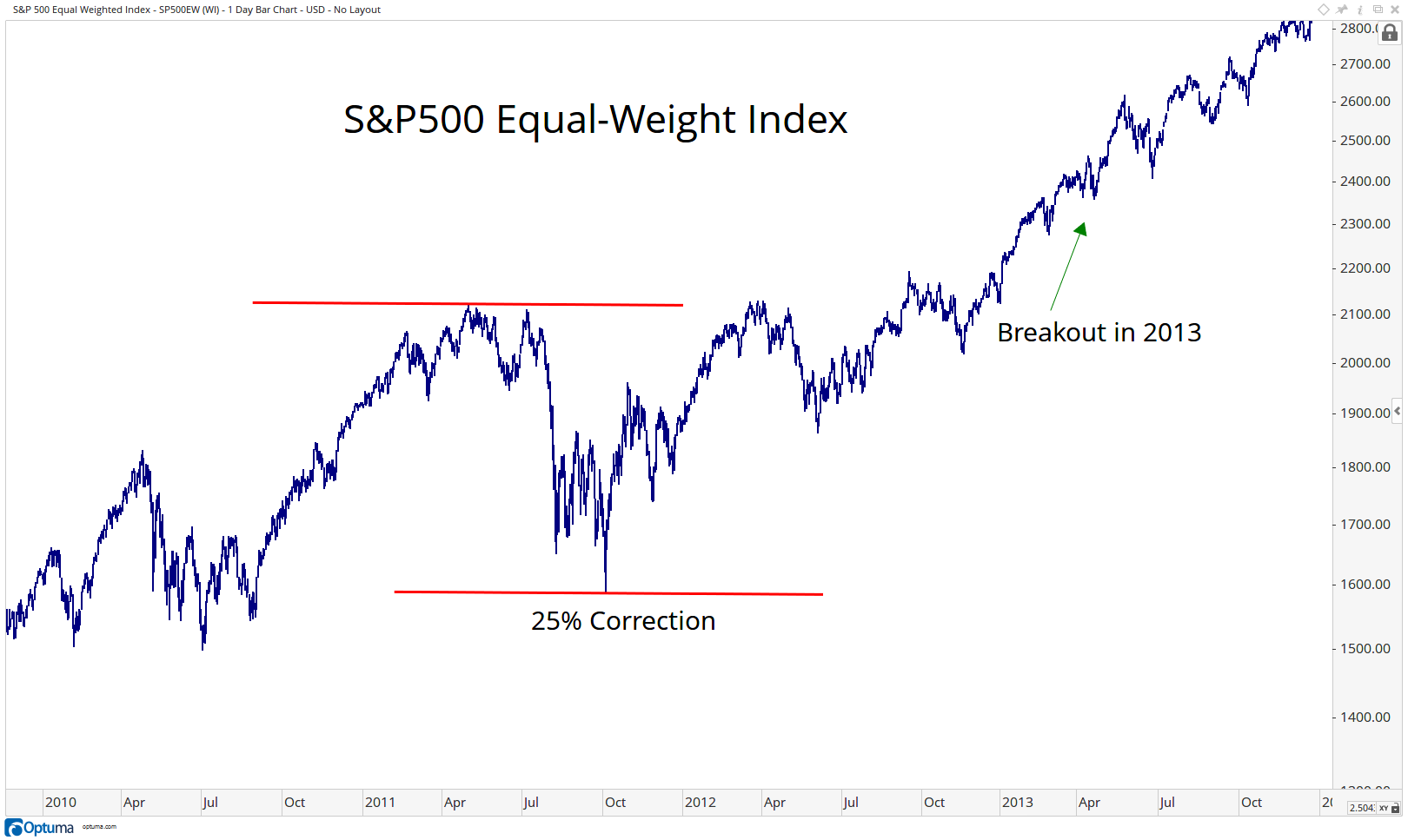

S&P500 Equal-Weight Index 2011 Correction –

-

S&P500 2013 Breakout –

-

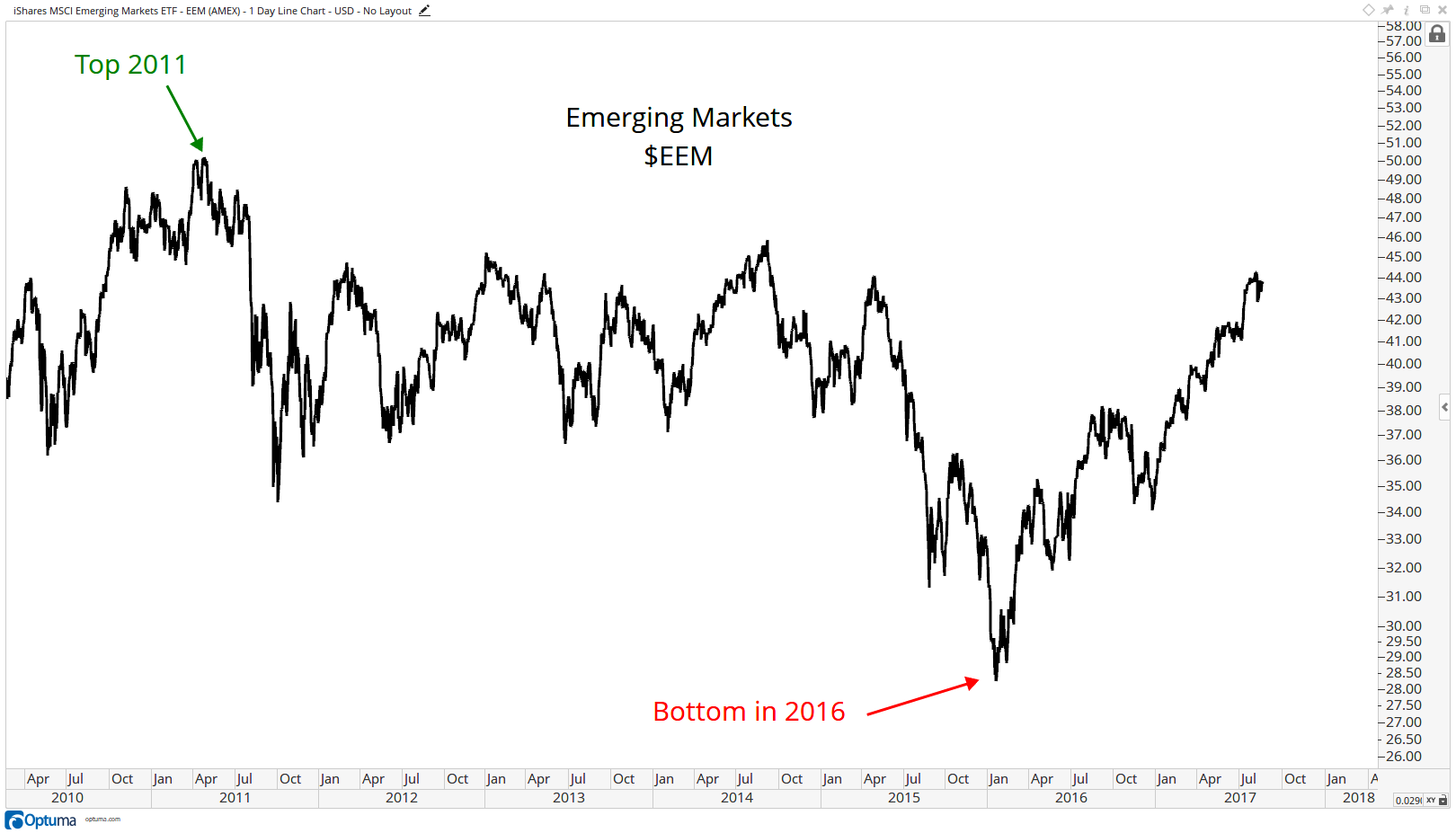

Emerging Markets 2011-2016 Decline –

-

Energy Relative To The S&P500 –

-

Industrials And S&P500 –

-

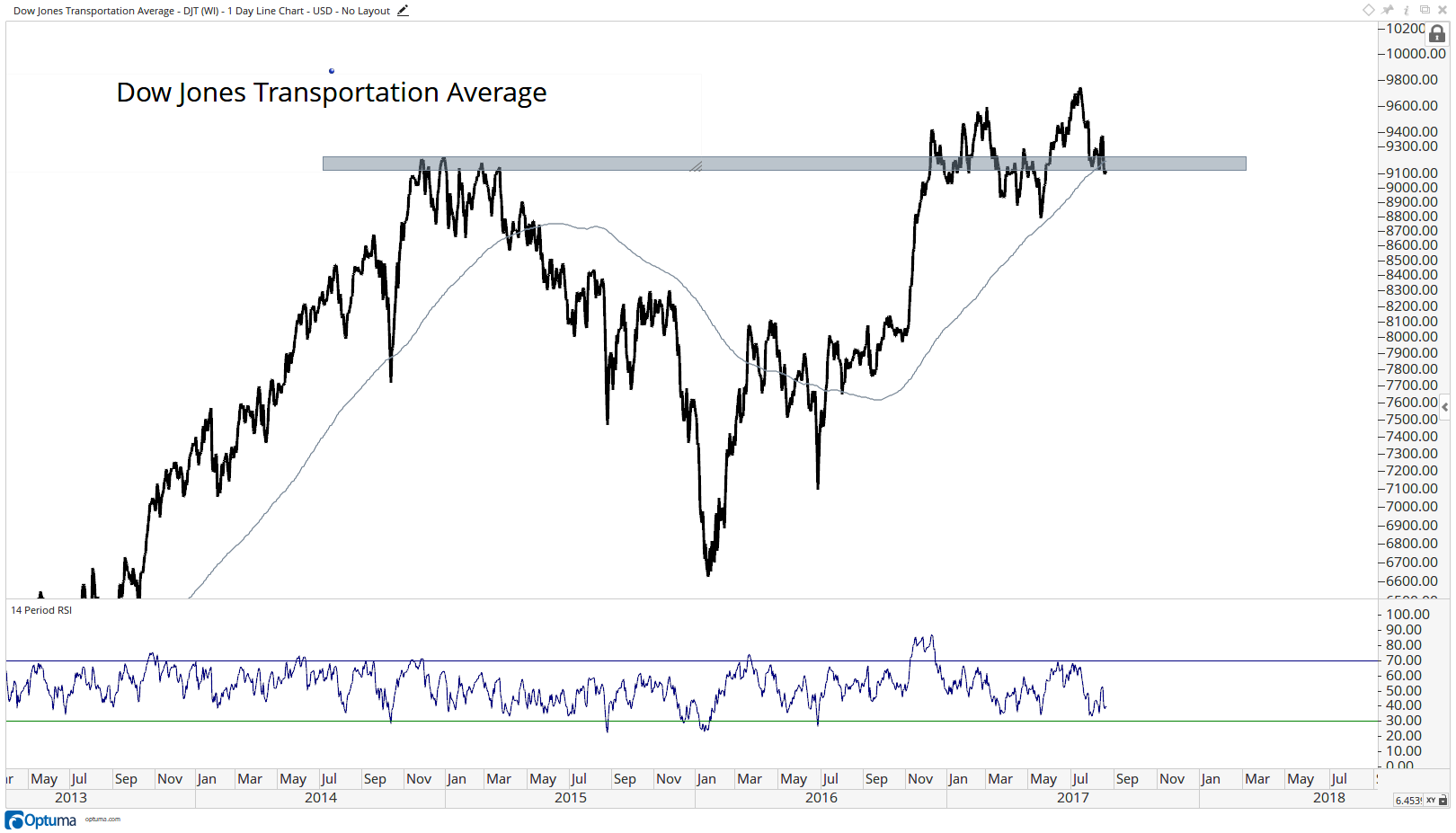

Dow Jones Transportation Average –

-

Dow Jones Trucking Index –

-

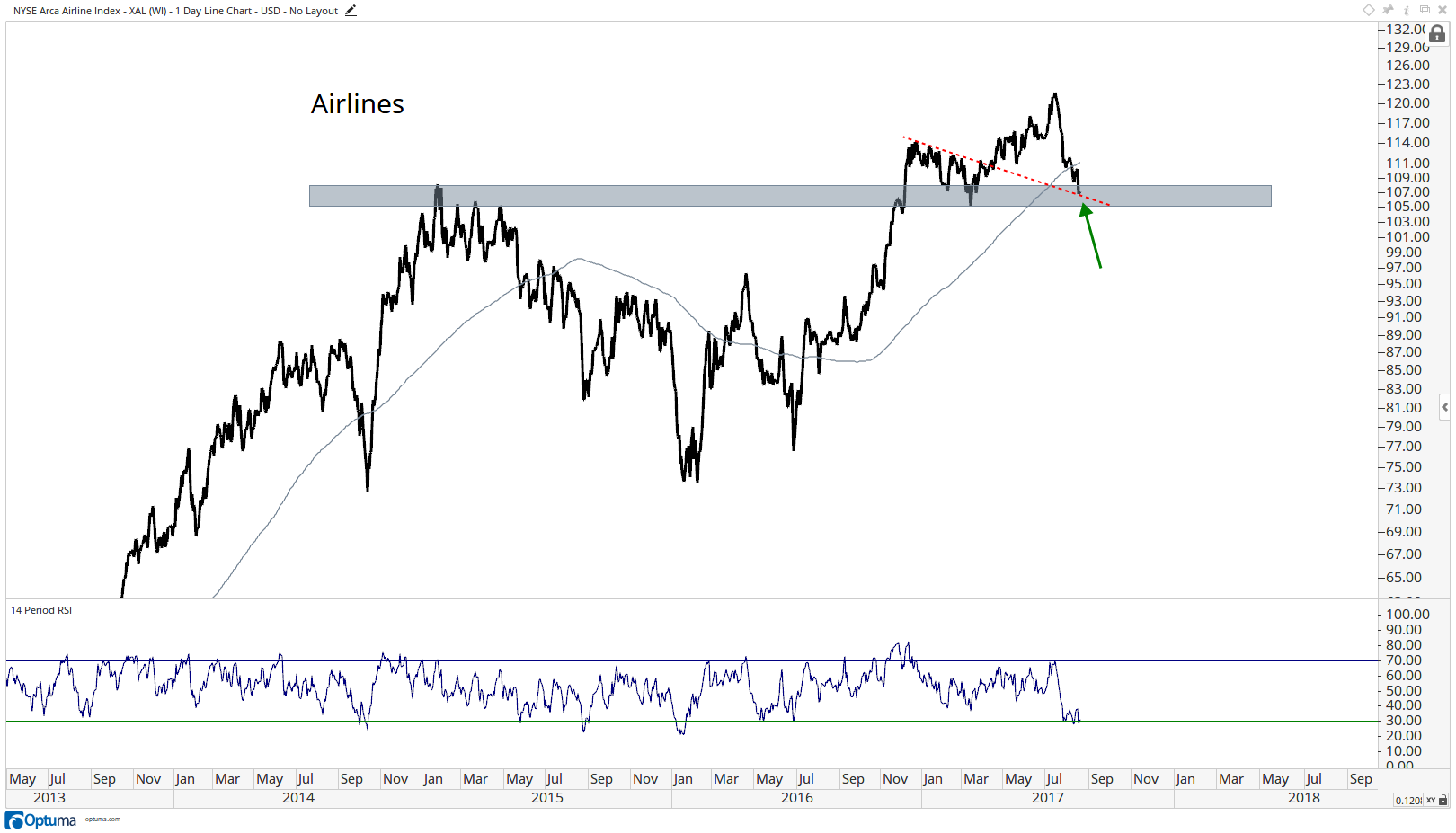

Amex Airlines Index –

-

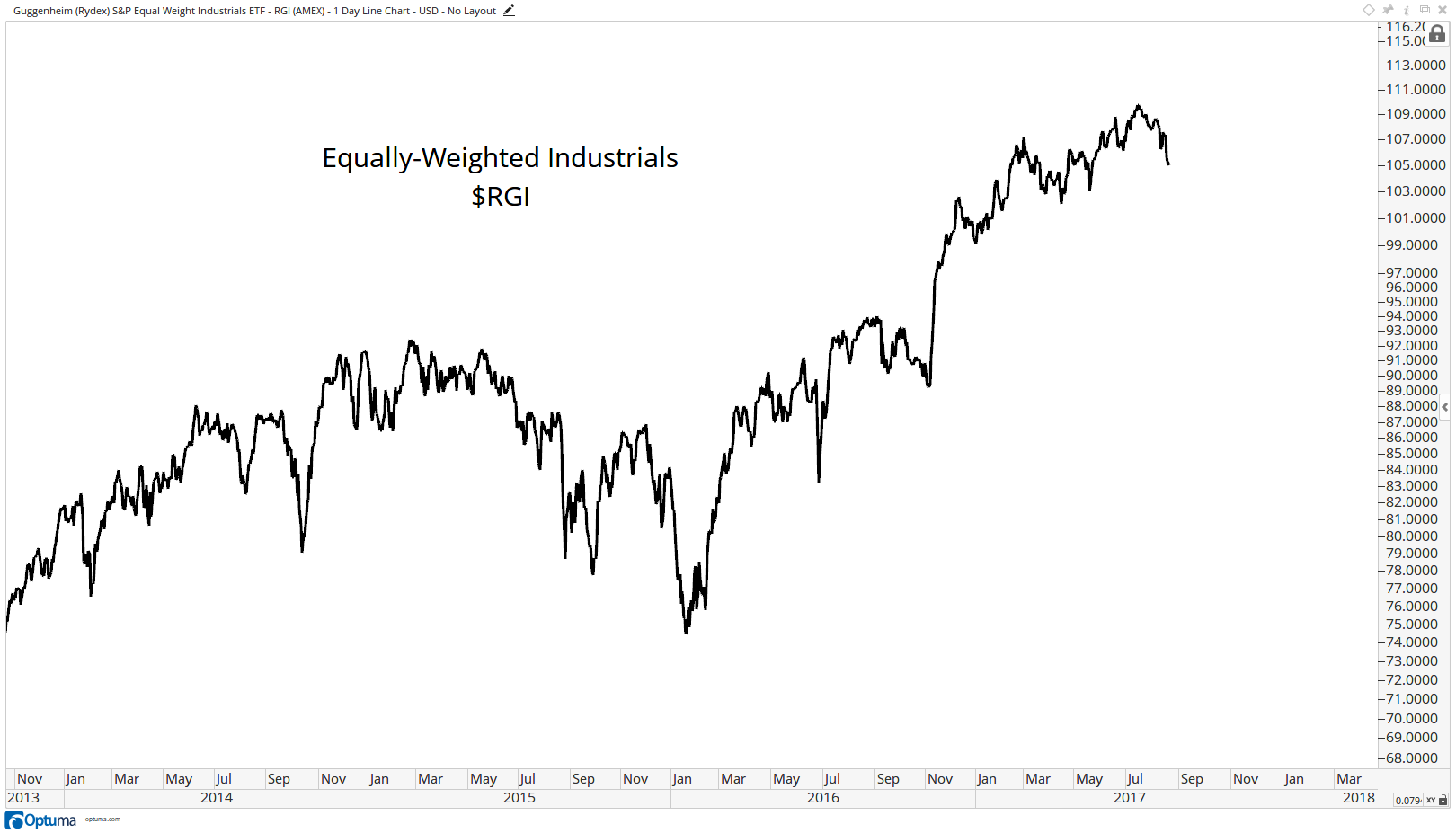

Equal-weight Industrials –

-

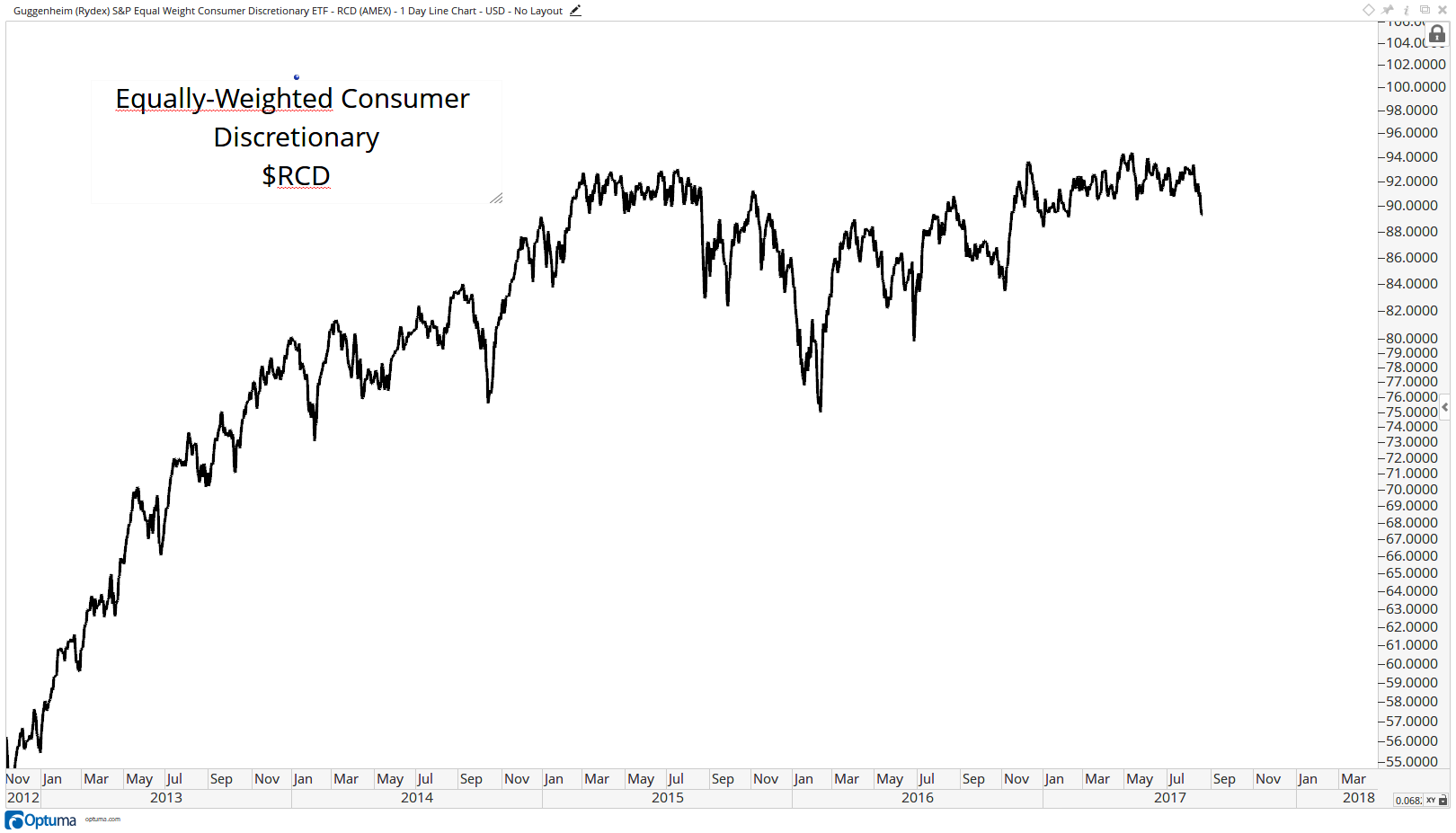

Equal-weight Consumer Discretionary –

-

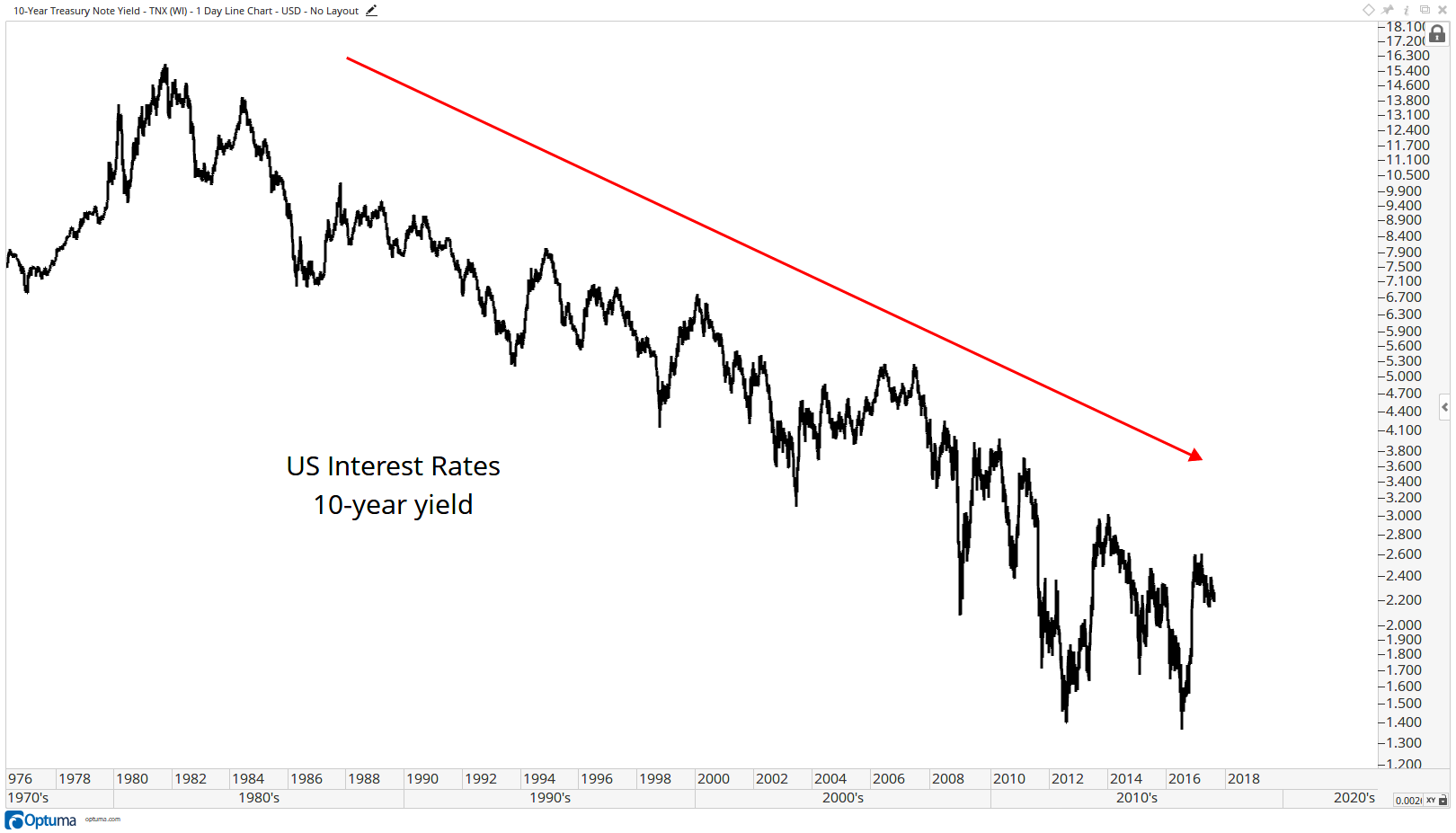

US Interest Rates: 10yr Yield –

-

US Interest Rates: 10yr Yield –

-

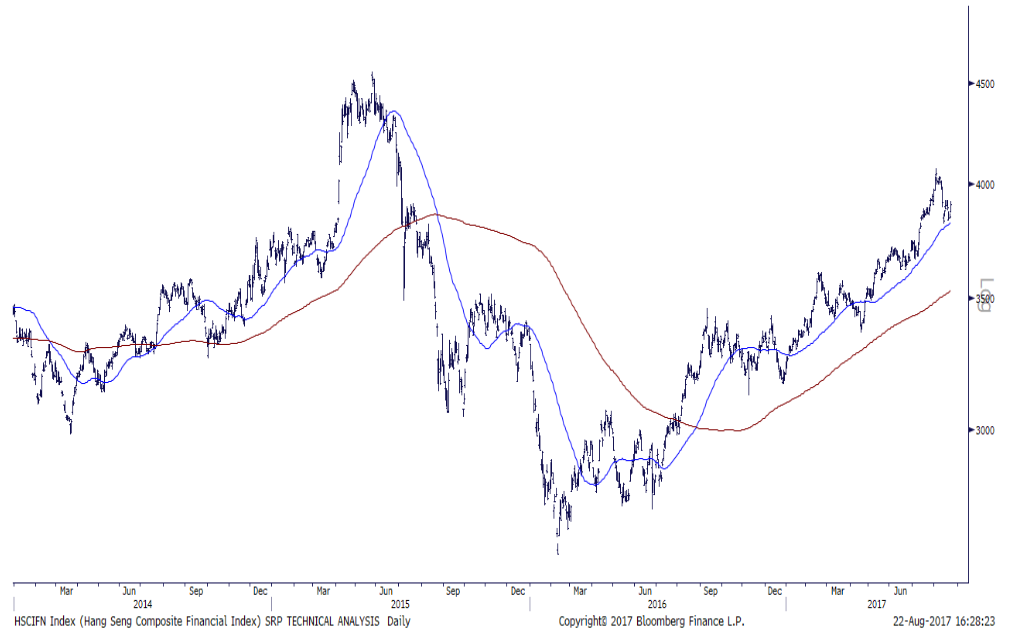

Hong Kong Financials –

-

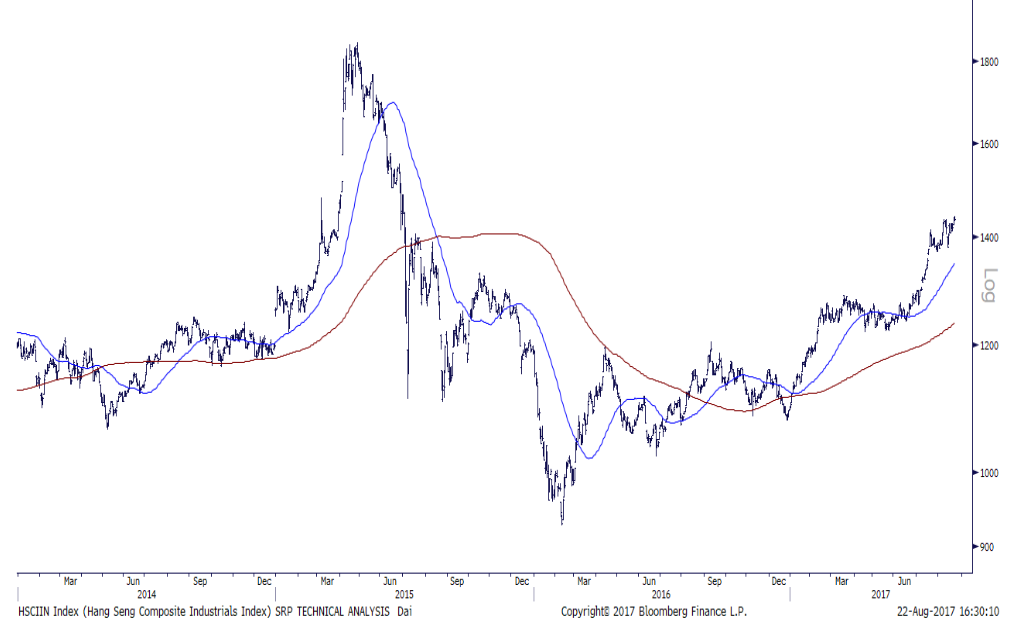

Hong Kong Industrials –

-

Copper vs Gold Ratio and Interest Rates –

Disclaimer: The information, opinions, and other materials contained in this presentation is the property of All Star Charts, a wholly owned subsidiary of Eagle Bay Capital, LLC, and may not be reproduced in any way, in whole or in part, without express authorization of the copyright holder in writing. The statements and statistics contained herein have been prepared by Eagle Bay Capital, LLC based on information from sources considered to be reliable. We make no representation or warranty, express, or implied, as to its accuracy or completeness. This publication is for the information of investors and business persons and does not constitute an offer to sell or a solicitation to buy securities or subscribe for interest in any investment. This document may include estimates, projections and other “forward-looking” statements, due to numerous factors, actual events may differ substantially from those presented. Opinions and estimates offered herein constitute Eagle Bay Capital, LLC’s judgment and are subject to change without notice, as are statements of financial market trends which are based on current market conditions. An investment in the fund is subject to loss of capital and is only appropriate for persons who can bear that risk and the nature of an investment in the fund. Eagle Bay Capital, LLC is not a registered investment advisor or registered investment company. These materials are not intended to constitute legal, tax, or accounting advice or investment recommendations. Prospective investors should consult their own advisors regarding such matters.