OVERVIEW

🔍 What Are Alerts?

Alerts are a powerful tool for every trader.

They’re automatic notifications you set up to get real-time updates when the price of an asset, an indicator, or any relevant market condition meets a specified criterion.

Whether it's price movement, trend reversals, Fibonacci retracement levels, moving average crossovers, or key support and resistance levels, alerts help you stay on top of the market without needing to monitor every chart constantly.

🤷 Why Are Alerts Important?

- Saves Time and Energy Alerts remove the need for constant chart-watching. Markets are active around the clock, and staring at screens all day can be draining and unrealistic for most people. Alerts keep you in the loop, sending you timely notifications without requiring you to be glued to your screen.

- Ensures Timely Actions With alerts in place, you won’t miss out on key opportunities. If a stock or cryptocurrency breaks through a critical level, you’ll know immediately and can act quickly. The timing alerts provide can make a big difference, especially in volatile markets.

- Supports Discipline and Strategy Alerts reinforce discipline in trading by reminding you when a pre-planned market condition is met. Without alerts, it’s easy to let emotions like fear and greed influence decisions, especially if you're caught by surprise. Alerts help you stick to your strategy, keeping you on track with your initial plan.

- Helps Manage Risk Alerts can play a big role in managing risk, especially by notifying you of price drops that reach your stop-loss levels. They can also help by alerting you to shifts in trend that may affect the risk of your open positions. With timely alerts, you can avoid large, unexpected losses.

- Customizable for Any Strategy You can tailor alerts for any trading style, from day trading and swing trading to long-term investing. Alerts can be as specific as notifying you when prices reach Fibonacci levels or hit a 20-day moving average. With the right alert setup, you can fine-tune your approach to the exact strategy you’re using.

🧩 Practical Tips for Setting Alerts

- Set Up Alerts Based on Your Key Price Levels: Use alerts to track critical price levels based on your technical analysis, like resistance, support, or Fibonacci retracement levels.

- Limit Alerts to Key Developments: Avoid “alert fatigue” by only setting alerts when you need them. This helps you focus only on important developments and cuts down on unnecessary notifications.

- Test Your Alerts Regularly: Some alerts can expire or fail, so checking in on your alert settings periodically is always a good idea.

Using alerts isn’t just about convenience; it’s about reinforcing your trading strategy, managing your risk, and ensuring you’re always prepared to take action when the market moves in your favor.

SETTING ALERTS

🖱️ Adding Alerts on TradingView

As shown below, to create an alert you need to right click a price level where you want to set the alert. In the example below, I set an alert when Ethereum hits its former highs.

🖱️ Managing Alerts on TradingView

When you have set the alert, you can manage and view both existing and expired alerts by clicking the clock icon on the right hand side.

From there, you can easily go through the charts of the securities/tokens you have alerts on.

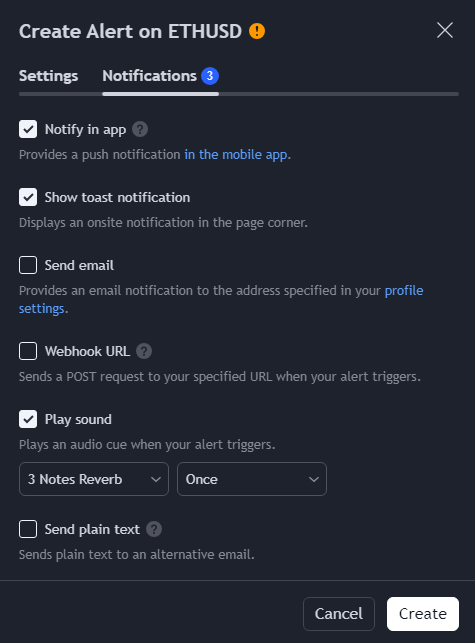

You can also manage how you are alerted when you initially create the alert.

The options include:

- App notification

- Or desktop notification

That marks the end of Module 4!

🎯 Key Takeaways from Module 4:

- You now understand the importance of trading alerts

- You know how to set and manage alerts

Progress:

- ✅ Module 1: Getting Started with TradingView

- ✅ Module 2: Charting Essentials and Drawing Tools

- ✅ Module 3: Using Indicators and Technical Analysis Tools

- ✅ Module 4: Setting Alerts and Managing Trades

- ⏳ Module 5: Advanced Tools

💡 Quick Tip: Don't give yourself alert paralysis. Limit your alerts to the big levels you're watching in a select few assets/cryptos. You want the alert to have weight and not to become something that you're accustomed to.

🔔 Up Next: I'll give you a few days to absorb this information and from there we'll move to Module 5 where we'll explore how to screen for cryptos.