Peloton Delivers

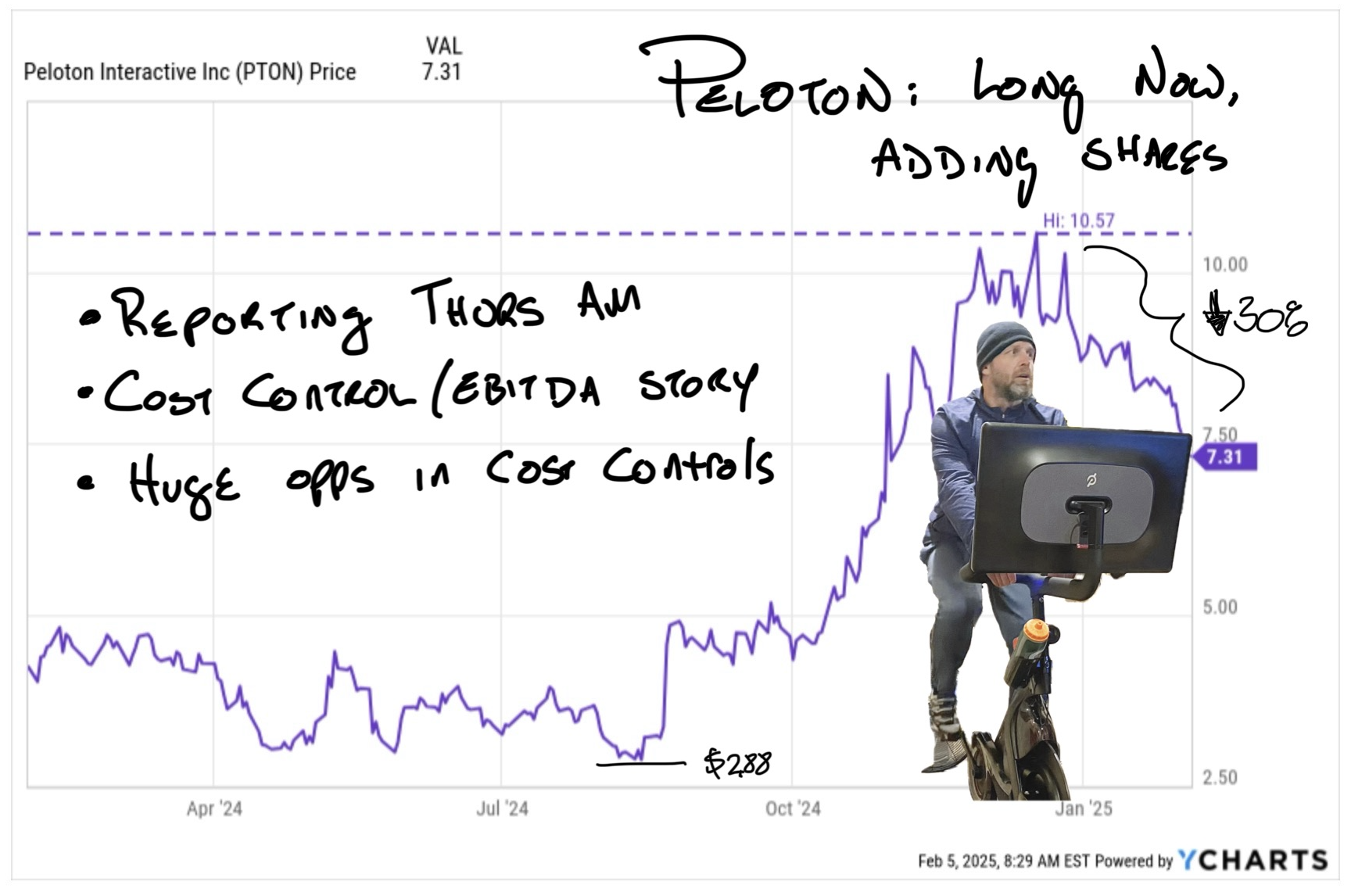

Connected Fitness kingpins Peloton delivered another strong quarter this morning and shorts are feeling the burn. Shares of the former COVID-Darling come laughing-stock were up as much as 20% early after Peloton reported a fourth straight quarter of positive cash-flow and upped its cash-flow estimate for the year from $125M to "at least $200M". Peloton also raised full-year guidance for EBITDA, ending subs and gross margins.

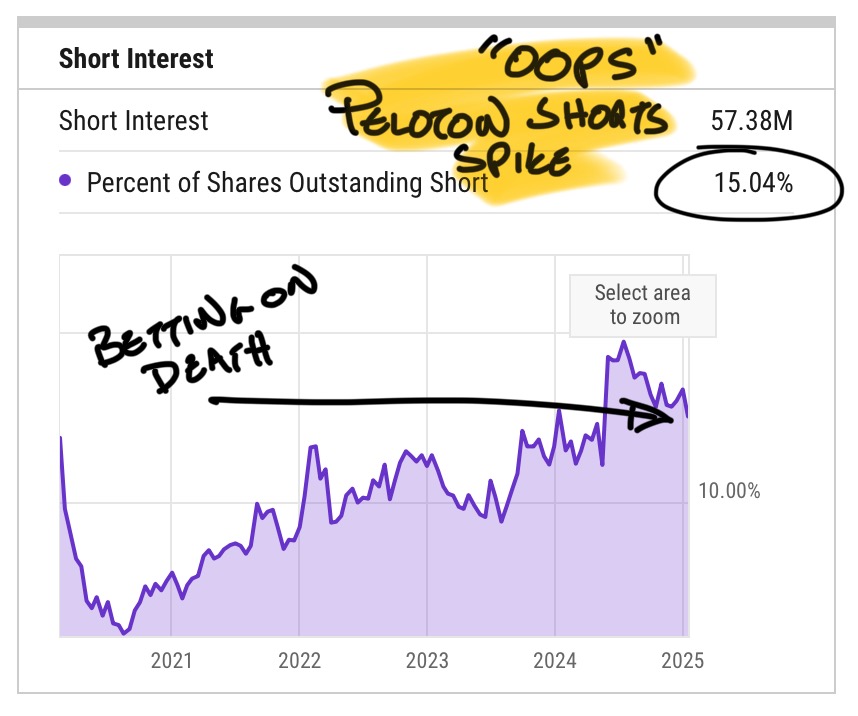

Now, there are levels to this profitability game. Peloton still has a shrinking subscriber base, negative EPS and an R&D budget that would embarrass DC. But what Peloton isn't doing is dying. With a 15% short base going into today's report "not dying" is more than enough to goose Peloton higher.

You want to hear a great company report? Listen to Amazon later today. There's room in the stock market (and my Starting 10 portfolio) for Best of Breed and Shaggy Dogs like Peloton. There's more than one way to make money.

Here's what I liked about the quarter and why I'm staying long Peloton:

Cash

Peloton used to think it could grow forever and spent accordingly. The company broke ground on a massive Power Plant factory in Ohio, spent $420 million buying Precor, opened scores of pointless retail stores (fun fact: The number 1 seller of Peloton Bike+s last quarter: Costco) and routinely ran through over $100 million per quarter in R&D. It's taken a few management changes but the spending is under control. R&D is down 25% year over year. There's a low-ball goal of cutting $200 million in expenses and that number is going higher.

Peloton is reducing spending without losing customers. With an enterprise value under $2.5b Peloton could be generating ~$300-$500M in Cash/Yr if nothing much goes right on the sales side. That might not be a value play but it's a lousy short.

Strategy

Peloton users are about 2/3 women. The treadmill market is 2x the size of the stationary bike market. Until the last couple quarters Peloton was unable to produce enough treadmills to meet demand (did I mention Peloton spent $420M buying a treadmill company?) and had no marketing directed to men.

In the last 6mo Peloton has finally gotten in front of tread demand. Last quarter Peloton's new users were 42% male, driven in large part by more effective marketing built around the Watt brothers of the NFL. Even better hardware markets are the double digits for the first time in five years, suggesting a previously elusive efficiency has been reached.

New CEO

Peloton's original CEO borrowed against his shares near the peak to build an estate in the Hamptons then rode the stock down to the point that he at least claims to have lost everything. Which is both sad and all we need to say about some of his decision making in terms of business.

The next CEO was a no-nonesense Netflix alum who had some good ideas but still felt like the lockdown didn't pull forward pretty much all the stationary bike demand there will ever be for the next decade. As a result he didn't reduce expenses enough and the company continued to disappoint.

Last May the board took over and reversed course on a dime. On January 1st Apple alum Peter Stern took over. As someone who (re)bought Peloton specifically because of the way the board was running the company, Stern had me nervous going into today's call.

I wanted business as the New Usual and that's what I got. Even better Stern is exploring fewer stores, less R&D and better retail relationships. Perfect.

No One Believes

As mentioned, Peloton is still 95% off All-Time-Highs and is less than a month removed from record high short interest. It's still a punchline to jokes about being a coat hanger. That's perfect. If the company can stay the course, keep over-delivering and avoid becoming a tariff victim I think shares take out recent highs and head back to the mid-teens.