You can learn more at BehavioralMacro.com

-

Emerging Markets & S&P500 2016 Bottom –

-

Emerging Markets & S&P500 2008-2009 Bottom –

-

Gold & Silver Top in 2011 –

-

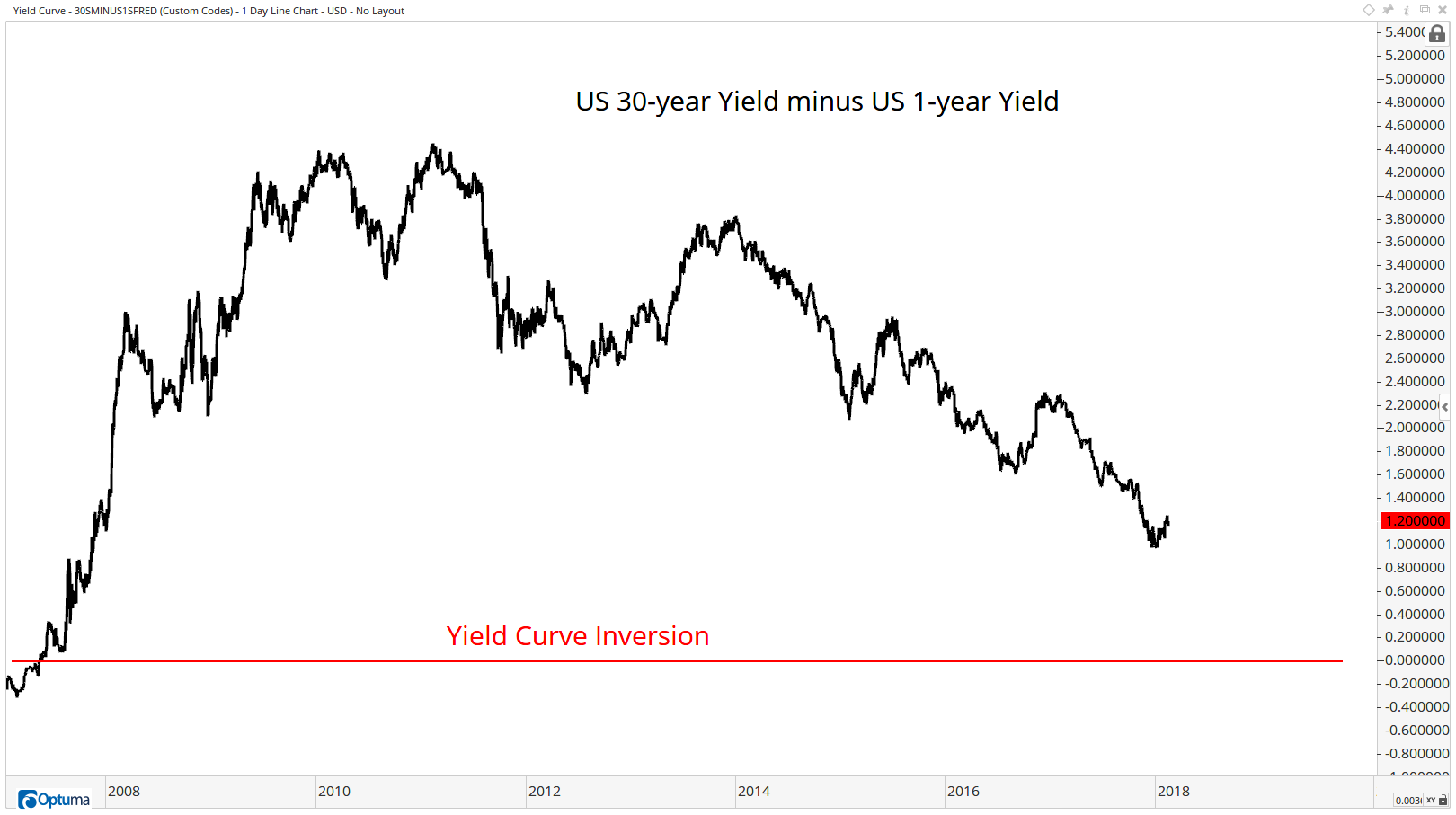

U.S. Yield Curve 1s/30s –

-

U.S. 10-year Yield –

-

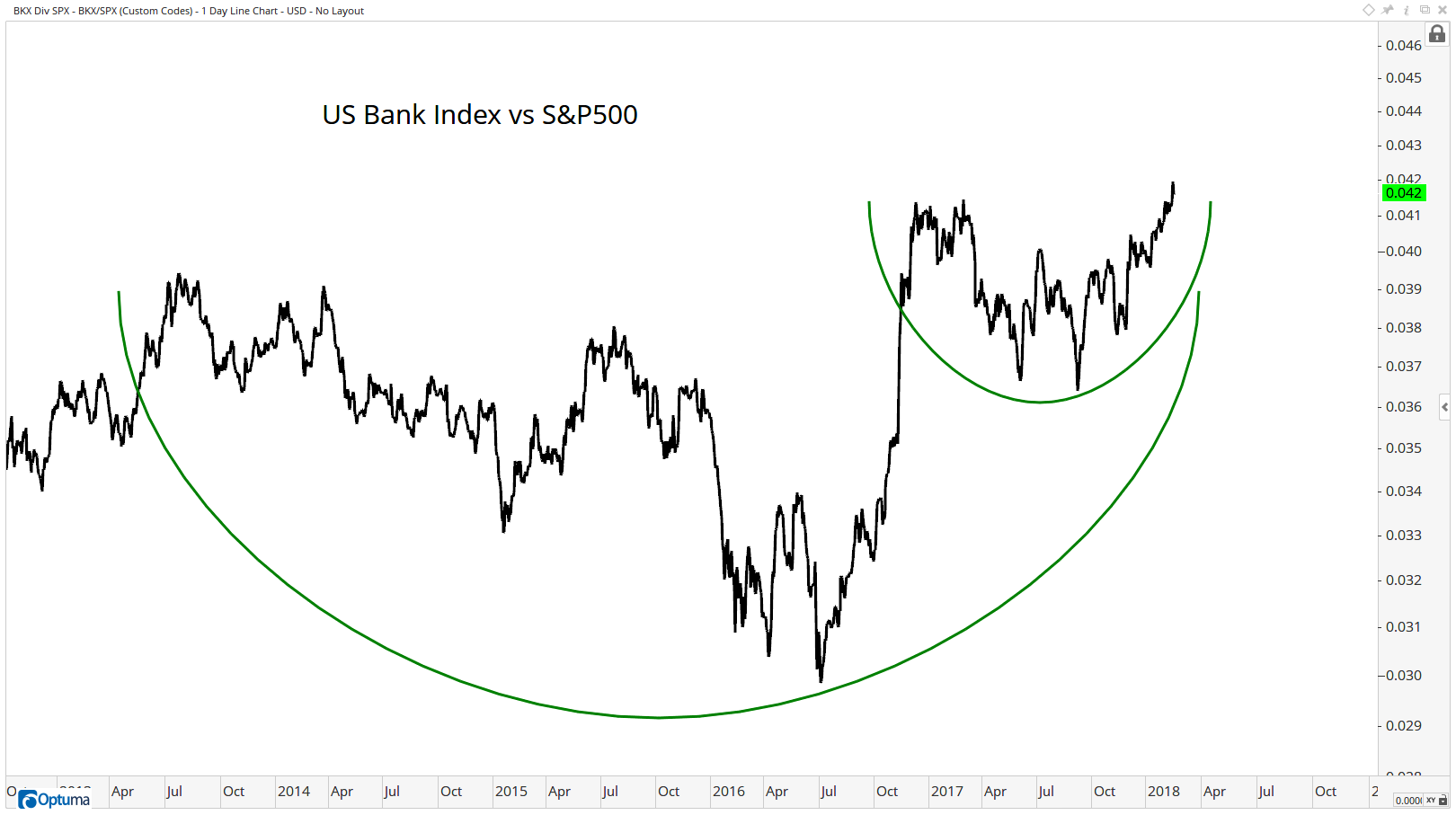

U.S. Bank Index vs S&P500 –

-

Crude Oil Futures –

Disclaimer: The information, opinions, and other materials contained in this presentation is the property of All Star Charts, a wholly owned subsidiary of Allstarcharts Holdings, LLC, and may not be reproduced in any way, in whole or in part, without express authorization of the copyright holder in writing. The statements and statistics contained herein have been prepared by Allstarcharts Holdings, LLC based on information from sources considered to be reliable. We make no representation or warranty, express, or implied, as to its accuracy or completeness. This publication is for the information of investors and business persons and does not constitute an offer to sell or a solicitation to buy securities or subscribe for interest in any investment. This document may include estimates, projections and other "forward-looking" statements, due to numerous factors, actual events may differ substantially from those presented. Opinions and estimates offered herein constitute Allstarcharts Holdings, LLC's judgment and are subject to change without notice, as are statements of financial market trends which are based on current market conditions. An investment in the fund is subject to loss of capital and is only appropriate for persons who can bear that risk and the nature of an investment in the fund. Allstarcharts Holdings, LLC is not a registered investment advisor or registered investment company. These materials are not intended to constitute legal, tax, or accounting advice or investment recommendations. Prospective investors should consult their own advisors regarding such matters.