Jason Perz and Sam Gatlin reveal the setups driving metals and macro markets.

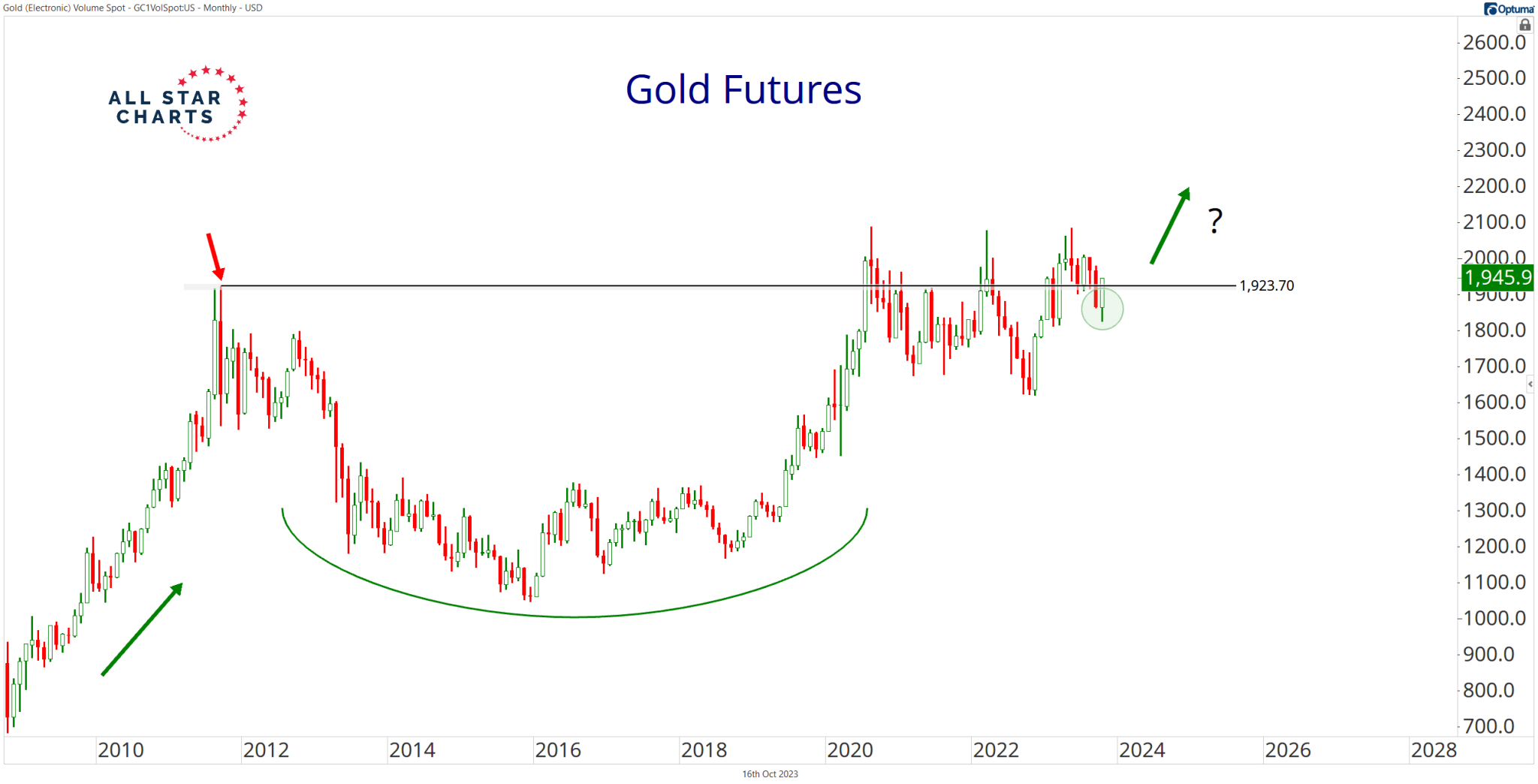

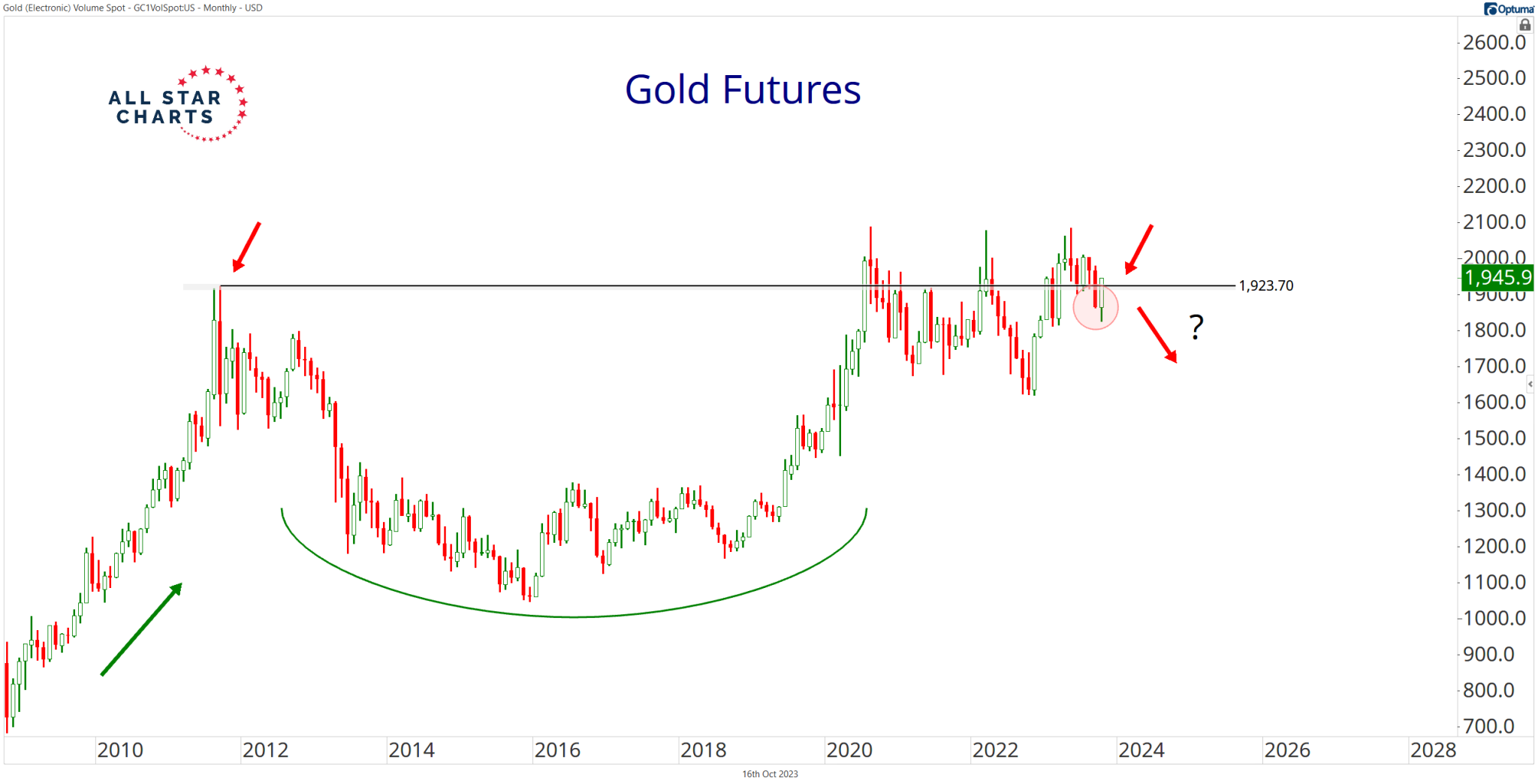

Follow the Metals Momentum

Gold Rush Report highlights the breakout setups, rotations, and technical signals shaping metals markets — giving traders an edge in gold, silver, and commodities.