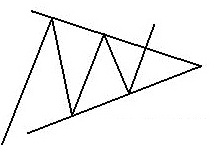

As I go through my charts, all I see are Symmetrical Triangles. They’re everywhere. Some might call them pennants, or coils, or a wedge. You can call it whatever you want. The best part of this whole thing is that it doesn’t matter what it’s called. What matters is what it means.

As I go through my charts, all I see are Symmetrical Triangles. They’re everywhere. Some might call them pennants, or coils, or a wedge. You can call it whatever you want. The best part of this whole thing is that it doesn’t matter what it’s called. What matters is what it means.

When I see these sort of converging trendlines after a big move, I look at it as a temporary pause in the overall move. More often than not, these consolidations resolve themselves in the direction of the underlying trend. In this case, the trend is clearly up.

Here is John Murphy’s take:

“The Symmetrical Triangle (or the coil) is usually a continuation pattern. It represents a pause in the existing trend after which the original trend is resumed…..(if the prior trend was up) the percentages favor resolution of the triangular consolidation on the upside. If the trend had been down, then the symmetrical triangle would have bearish implications”

Chart by chart, I keep seeing it:

Also see:

The Current SP500 SPY Symmetrical Triangle Pattern (AfraidToTrade)

Stocks Now Stuck in Third ‘Ginormous Range (WSJ)

Source:

John Murphy – Technical Analysis of Financial Markets

Tags: $SPX $SPY $DJIA $DIA $NYA $XLY $XLB $XLI $XHB $RUT $IWM $MDY $TRAN