My, my, how time flies!

Doesn’t it feel like just yesterday we were starting out the year with the Dow up 300 points?

Good times….

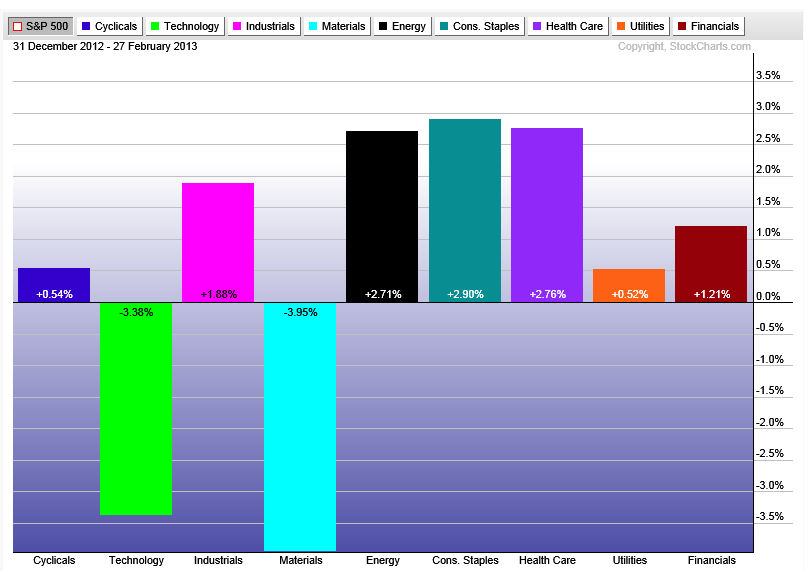

Anyway, I think now is probably as good a time as any to reflect on what we’ve seen over the last couple of months. Here is a performance chart showing how each of the S&P sectors have done so far this year relative to the S&P500. It’s a good way for us to see where the strength is coming from as we approach these all-time highs in the Dow Jones Industrial Average and S&P500.

The best two sectors for 2013 have been Consumer Staples and Healthcare!

The worst areas so far this year are easily Technology and Materials – funny how much they stand out in this chart with their fluorescent coloring.

I think this is probably something we should pay attention to. If the market averages want to keep ripping, some of the more cyclical areas better start participating. This defensive leadership is not what we want to see.

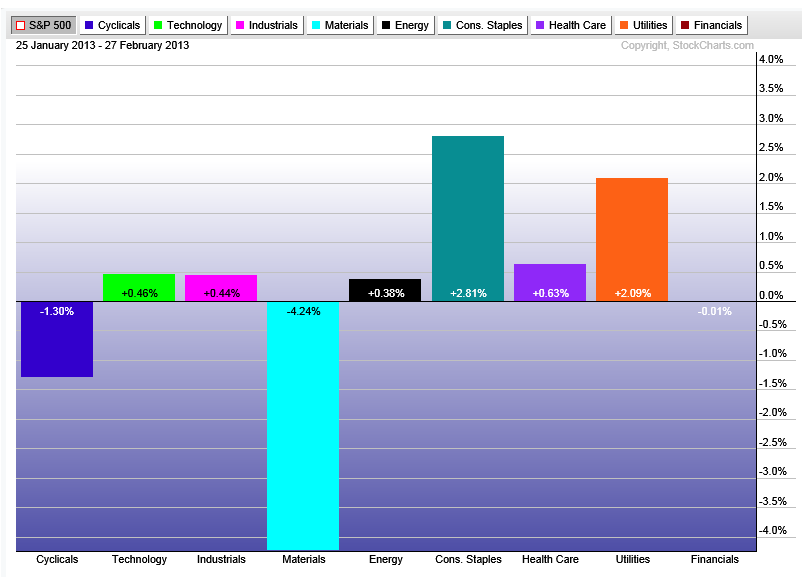

And here’s same chart showing just the past month. The leaders were Staples and Utilities. Materials and Consumer Cyclicals were the worst:

Tags: $XLP $XLV $XLK $XLB