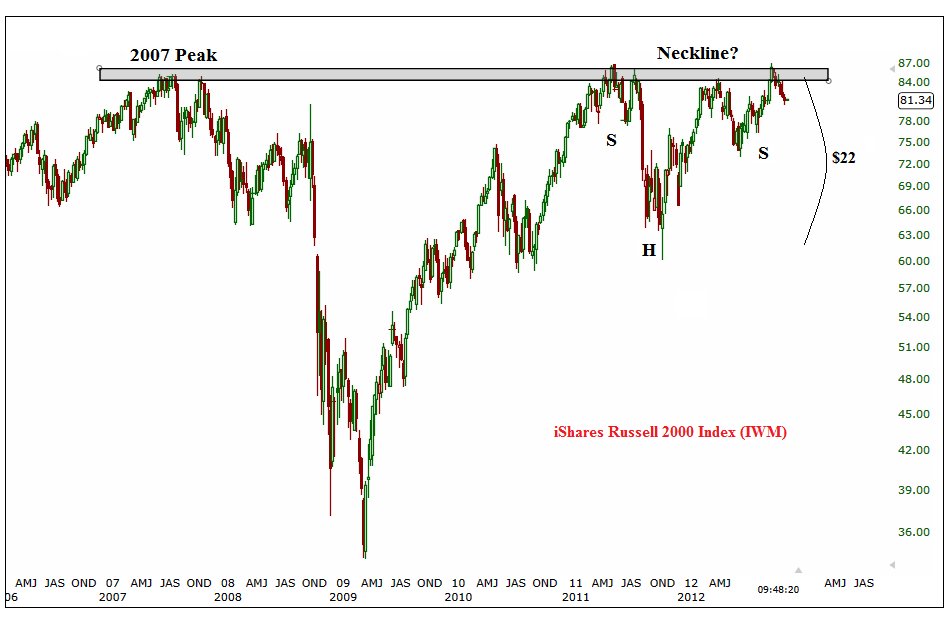

Today I wanted to show you guys a six year weekly chart of the Russell 2000. I think there is a lot of information in this one. We’ll use the iShares ETF $IWM to keep things nice and simple.

The first thing we notice is the resistance going back to the 2007 highs that was tested last year, again this March, and again in September (S&P500 isn’t acting like this). The next thing that catches your eye is the fact that these tests of all-time highs are coming quicker and quicker and not taking 4 years like it did between the 2007 & 2011 tests. (Click Chart to Embiggen)

If you take a look at the action over the last 2 years, the classic price pattern guys would tell you that this looks like an inverse head & shoulders. The problem with calling it that this early is that we won’t know if it is or isn’t until the “Neckline” is taken out. To me, the left shoulder was last Spring, the Head came at the, “Europe is coming to end”, Fall lows last year, and the right shoulder at this year’s June lows. This gives us a $22 measured move, which puts the Russell 2000 up near 110. I’m being conservative with this number by using weekly closing prices. But you more aggressive technicians might use $27. Either way, it would be a nice argument to have down the road. Let’s worry about it then.

From an intermarket perspective, I think there is a ton of valuable information we can gather from this action in Small-caps. If you think Equities are the place to be, then you really need to see those highs taken out. Until then, this chart gives us a little bit more of a neutral reading, but with HUGE potential.

This is definitely an interesting one…

Tags: $IWM $RUT $TF_F $RUTX $TWM $SRTY $UWM $RWM $URTY