It’s the last week of summer and we’re not really expecting much. The final August work week is usually a snooze-fest. I hope I’m wrong, but probably won’t be. It’s just that time of year. So let’s not force anything if it isn’t there. As Ted Williams said, the most important thing is to get a good pitch to hit. Not mechanics. In other words, be patient and let it come to you. He also said that a good hitter can hit a pitch in a good spot three times better than a great hitter can hit a ball in a questionable spot. Think about that for a minute.

And with that, here are a few words of advice that some top technical traders have given us over the years:

They (traders) would rather lose money than admit they’re wrong… I became a winning trader when I was able to say, “To hell with my ego, making money is more important” – Marty Schwartz

To succeed as a trader, one needs complete commitment… Those seeking shortcuts are doomed to failure. And even if you do everything right, you should still expect to, lose money during the first five years… These are cold, hard facts that many would-be traders prefer not to hear or believe, but ignoring them doesn’t change the reality. – Mark D. Cook

The key to trading success is emotional discipline. Making money has nothing to do with intelligence. To be a successful trader, you have to be able to admit mistakes. People who are very bright don’t make very many mistakes. Besides trading, there is probably no other profession where you have to admit when you’re wrong. In trading, you can’t hide your failures. – Victor Sperandeo

There are old traders and there are bold traders, but there are very few old, bold traders. – Ed Seykota

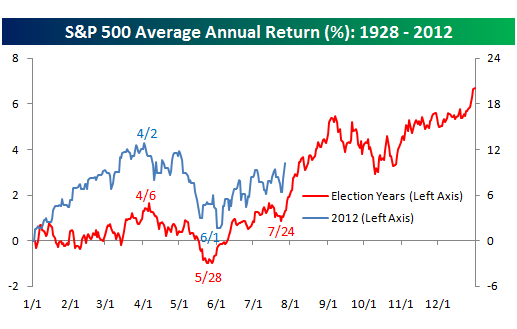

Everything’s tested in historical markets. The past is a pretty good predictor of the future. It’s not perfect. But human beings drive markets, and human beings don’t change their stripes overnight. So to the extent that one can understand the past, there’s a good likelihood you’ll have some insight into the future. – James Simons

You have to know what you are, and not try to be what you’re not. If you are a day trader, day trade. If you are an investor, then be an investor. It’s like a comedian who gets up onstage and starts singing. What’s he singing for? He’s a comedian. – Steven Cohen

Don’t be a hero. Don’t have an ego. Always question yourself and your ability. Don’t ever feel that you are very good. The second you do, you are dead… my guiding philosophy is playing great defense. If you make a good trade, don’t think it is because you have some uncanny foresight. Always maintain your sense of confidence, but keep it in check. – Paul Tudor Jones II

Thanks guys!

Sources: