Just a little experiment

Archives for July 2012

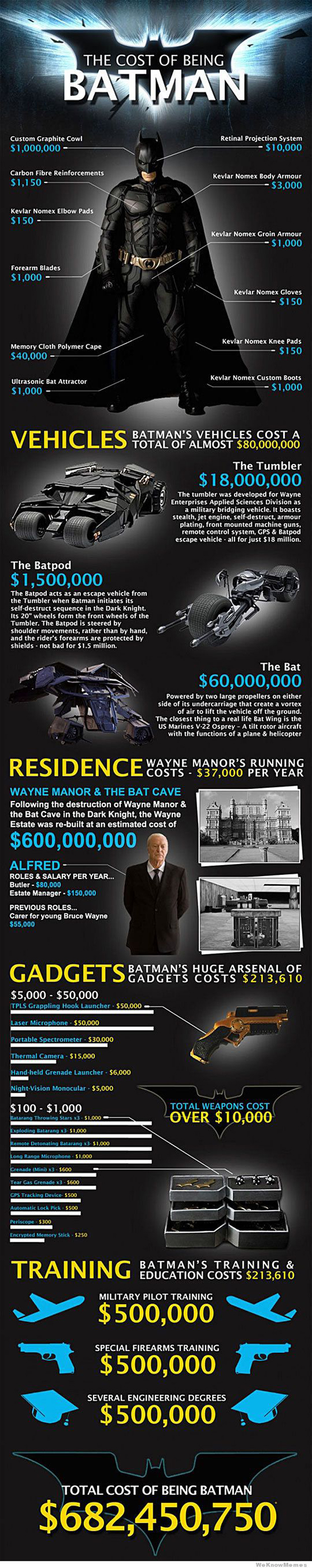

The Cost of Being Batman: $682,450,750

We Like August In Election Years

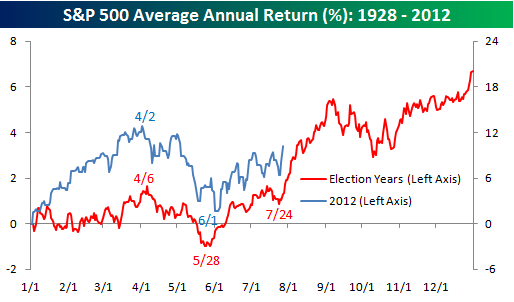

It’s hard for us not to be optimistic going into the month of August. Forget about all of the trendline breaks and multi-decade lows in bullish sentiment for just a minute and let’s just look at seasonality. Specifically, focus on the typical late-summer buoyancy in stocks during election years.

According to the my trusty Stock Trader’s Almanac, the Nasdaq has returned an average of 2.7% and the Russell2000 3.5% during the month of August during Election Years. The Dow Jones Industrial Average and S&P500 have also averaged positive returns since 1950 but lag the others returning just 0.8% and 0.9% respectively.

For you guys keeping score at home, this year’s stock market has followed its historical pattern very nicely. This is a chart from Bespoke Investment Group showing the historical pattern for the S&P500 on election years going back to 1928 (in red, this year in blue). Look at August:

Sources:

August Best Month in Election Year (StockTradersAlmanac)

Can It Really Be That Easy? (Bespoke)

Tags: $IWM $QQQ $SPX $DJIA

Are Interest Rates at a Key Inflection Point?

Today we have a guest post from my friend and fellow Technician James Bartelloni. He is a U.S. Navy veteran and spent 12 years in the cockpit as a TOPGUN graduate in the F-14. Having graduated from the US Naval Academy with a BS in Mathematics, he later went on earn his Chartered Market Technician Designation. Bartelloni is now a Portfolio Manager for V50 Capital Management.

I think you’ll enjoy Bart’s take on Fixed Income – JC

***

In order to get a feel for the markets, it’s necessary to monitor the “circle of life” consisting of Fixed Income, Equities (global and CONUS), Commodities and the Foreign Currency Market. One of these markets is at very key levels – the fixed income market. Even within a single instrument we look at different investment options. In this case we look at futures, ETF’s and Mutual Funds to seek confirmations of potential bull/bear inflection points.

Knowing full well the FED is on everyone’s mind this week, we thought it would be important to look at what the charts are saying in the fixed income market. Three investment vehicles are presented: $ZB_F (Long Bond Continuous Monthly Chart), RYJUX (Mutual Fund) and $TLT (ETF). Using some basic, yet powerful, techniques one can see we are at or approaching key inflection points from both a PRICE and TIME perspective. (click charts to embiggen)

1) Long Bond Future: exceeded the standard deviation bull channel but is pausing right at the extreme measured move of bullish price movement. Additionally, other price projection techniques not shown are confirming this area to be strong resistance. Mind you, much like the parabolic runs in Gold ($GC_F) and Apple ($AAPL), exceeding a standard deviation channel can/will ultimately cause price action to come back into the channel but not before it potentially explodes in the direction of the break. This is a 30 year run at extremes in price …. stay tuned.

2) RYJUX: a mutual fund that corresponds, inversely, to price movement. It’s symmetrical march down confirms the Long Bond. However, note the PRICE/TIME convergence appearing…could be forecasting a nice bounce or, perhaps, a major low?

3) TLT: for any Elliot Wave aficionado’s a 5 wave move UP is completing. This ETF is hitting numerous targets in addition to the 5 wave count shown.

Bottom Line: interest rates, as shown by these three basic charts, are at a key inflection point. Stay tuned …..

h/t Bart

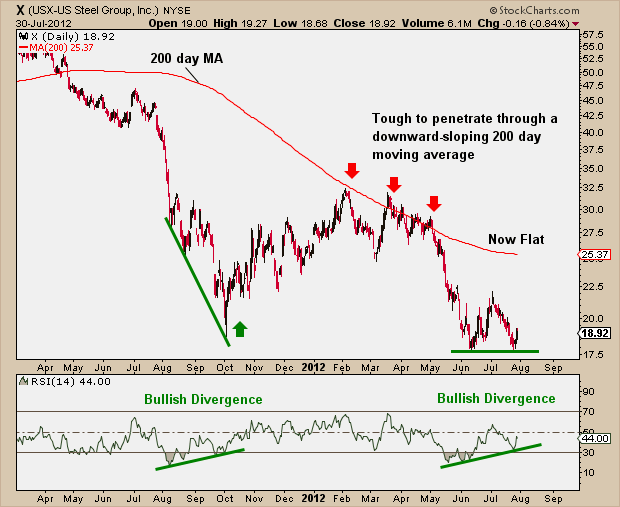

The Risk vs Reward in US Steel

I swung by Bloomberg headquarters on my way home this afternoon to do a quick hit on their Street Smart show. They basically get a Fundamental guy, a Technician, and an options trader to fight over a specific topic. Today’s discussion was on US Steel, a name I happen to like from a risk/reward standpoint. The other two guys didn’t.

It’s hard to ignore the fact that the recent correction back to $18 has allowed the 200-day moving average to flatten out. This makes it a lot easier to penetrate, as opposed to the downward slope it had when it attempted to breakout back in the Spring. More importantly (I didn’t get to mention this on air), momentum has started to turn up. The relative strength index put in a higher low during last week’s retest of 18 creating a nice bullish divergence. I certainly wouldn’t want to be short this name after seeing that sort of support/momentum combination.

Think about it: the 2012 highs are up near $32 and last year’s highs are up above $60. So to risk a dollar with that much upside and momentum already turning seems like a no-brainer to me. Risk management is the key as always, and Andrew Keene made a good point about keeping that tight stop under 18. Anything above that and I think it makes sense.

Here’s the clip:

And here’s the chart:

Source:

US Steel: 200 Day Moving Average Flattens (Bloomberg)

Tags: $X $SLX

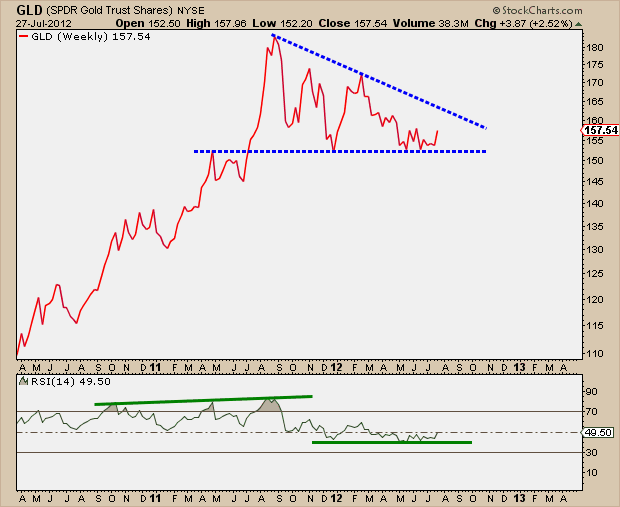

Decision Time For Gold Is Approaching Quickly

I’m not hearing a lot of chatter out there about the infamous yellow metal. You see, when Gold is making all-time highs, it’s all that everyone likes to talk about. But when it’s in the process consolidating those gains, market participants and the media get bored with it. Gold apparently loses its sex appeal when it doesn’t do anything.

Fortunately for those paying attention, corrections like this present a nice opportunity to jump on one of the strongest, most powerful trends on earth. It’s no secret that the price of Gold has been rising for over a decade, both on an absolute basis and also relative to Stocks. But sometimes people forget and rather focus their attention on disastrous social media offerings. They’re much sexier I suppose.

The thing is that stocks are like us humans in some ways. We get tired at times. There is no way we can just sprint and sprint and go on forever. At some point, we need to stop racing, settle down, relax, and take a nap. Stocks, commodities, and other securities behave the same way. And I think this is exactly what we’re seeing in the price of Gold.

Look at this chart below. It’s a weekly line chart of the Gold Exchange Traded Fund ($GLD):

Since the parabolic move in the 3rd quarter of 2011, gold prices have been consolidating in what appears to be a healthy normal correction. We’re going on 10 months now of coiling action that should see a resolution soon. The former resistance in April of last year near $150 has turned into support since December. We know right off the bat that a weekly breakdown below 150 would probably lead to a much longer correction and lower prices. But a break above the downtrend line from last September’s top should lead to a much higher prices for the 2nd half of the year.

The trend here has been higher for a long long time, so we’re still giving the benefit of the doubt to the bulls. Innocent until proven guilty, if you will. And our momentum indicator, RSI, agrees with that. First of all, the higher highs in RSI confirmed the higher highs in price throughout last year without showing any bearish divergences. Secondly, support was found in momentum well above 30, never showing any oversold readings. These are both signs of a security still in bull mode.

All of these are bullish characteristics that lead us to believe that higher prices are here to come for Gold. But discipline is the key. If we get down below 150, this isn’t an area where we want to be for the near-term. But as long as we stay above it, we like it to $180, $200, and beyond.

Tags: $GLD $GC_F $NUGT $UGL $DGP $QO_F

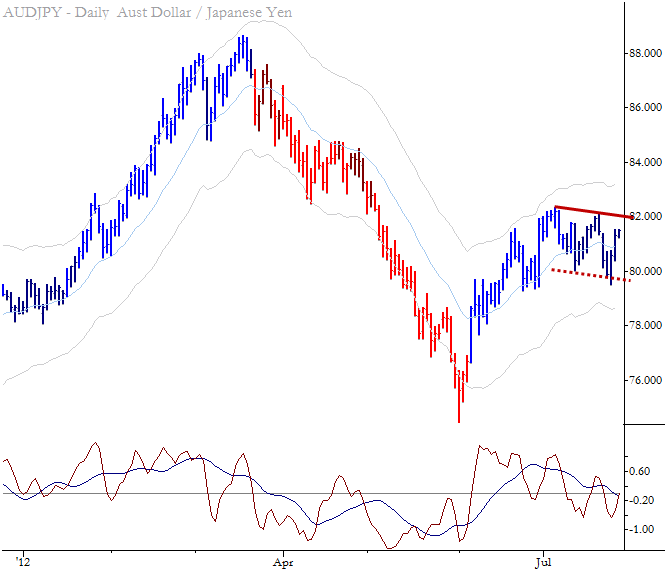

Is That A Bull Flag In Aussie-Yen?

Today’s chart of the day is brought to us by Technician and Author Adam Grimes. I’m a newcomer to Grimes’ blog but I’ve learned quickly that it is a must read for technicians. I suggest adding this one to your preferred feed.

This morning he brings up a great chart with some serious implications for risk assets. If Grimes is right and this indeed is a bullish pattern, look for stocks and commodities to follow higher. I would then expect further downside pressure in the US Dollar, Treasuries, and the $VIX. But keep an eye on this 77-79 area where Grimes suggests keeping a stop. Lower lows in this currency cross would nullify the bullish implications and would force us to get much more defensive in general.

“This is potentially a very bullish pattern on the AUDJPY, targeting a move into the high 87′s over the next several weeks. Trades should be entered on strength above the trendline (roughly 82.00 in today’s trading) against a stop somewhere in the 77.00-79.00 area. (Remember, a closer stop is more aggressive.) Initial profits could be taken at a point equal to one times the initial risk on the trade, with further reductions as the trade plays out.”

Keep up the good work Adam! Love the blog.

Source:

Chart of the Day: Bullish Pattern in the AUDJPY (AdamGrimes)

Tags: $FXA $FXY $AUDJPY

Structural Bull Market in Tech, Not So Much for Financials

When markets crash, and I mean really crash, we shouldn’t expect anything but Time to fix the problem. It’s not a single event that marks the bottom, it’s a process.

We’ve written about the structural bull market in the Nasdaq100 that appears to be getting going (see here). But the Financials still have a long way to go. Remember, they just crashed a few years ago. Technology, on the other hand, was a decade ago.

Louise Yamada, one of the best that ever did it, was on CNBC last night explaining the differences in their structural pictures. She points to the relative strength in Tech and Financials as the important charts to watch. I have to agree.

Her Analysis gets going at the 4:28 mark:

Source:

Technical Signals Point to Structural Bull Market (CNBC)

Tags: $XLF $XLK $SPY $QQQ

- 1

- 2

- 3

- 4

- Next Page »