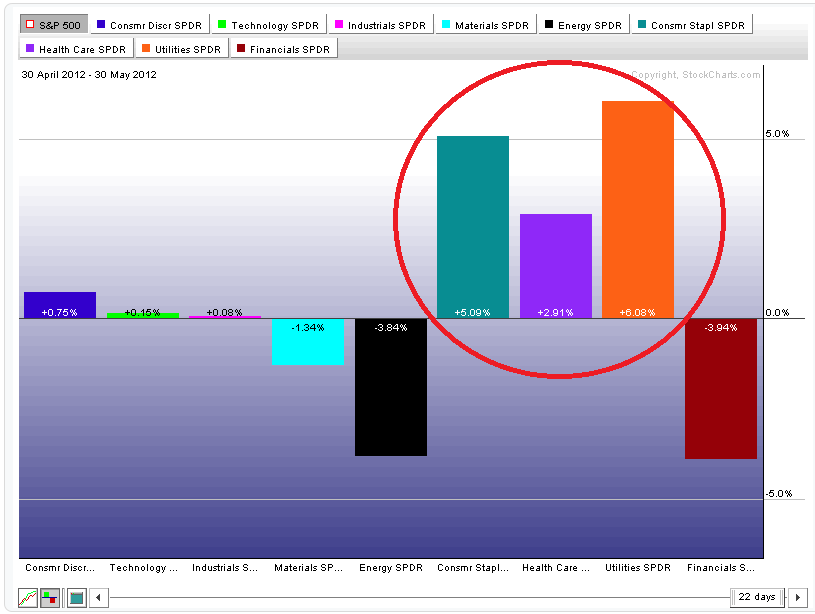

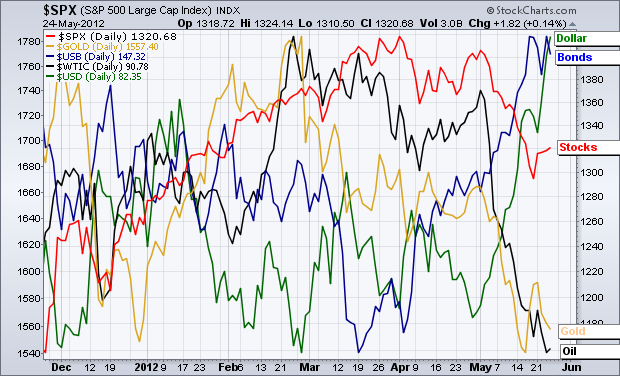

These are not the sectors that should lead in a bull market. When S&Ps are making new highs, you want to see Discretionaries, Technology, Financials and the commodity based areas also outperforming the major averages. In May we saw the complete opposite – and the Stock Market struggled. Healthcare, Consumer Staples, and Utilities all showed their leadership qualities over the past month.

This is a chart of each of the S&P Sector ETFs relative to the S&P500. Notice the clear outperformance in the defensive names:

We talk about sector rotation here all the time. But we’re seeing the importance of this before our very eyes. If US Equity averages are going to put in a key bottom, rotation needs to follow.

I’ll be waiting for relative outperformance in these key sectors as confirmation that we should be putting money to work into risk assets.

Tags: $XLF $XLY $XLP $XLV $XLU $XLI $XLK $XLE $XLB